IIFL has Founded in 1995 by Nirmal Jain and it is a public trading company, headquartered in Mumbai, India. The financial institution provides full-service brokers, Investment advice, Stock analysis using smart web tool resources, Targets high goal-oriented customers, and charges them with high side brokerage fees.

The IIFL Demat account holds their customer’s securities in digital form, and the securities are deposited in NSDL or CDSL. IIFL trading account makes the customers operate their Demat account to trade.

Note: NSDL full form is National Securities Depository Limited & CDSL full form is Central Depository Services Limited.

IIFL Securities Fees on Customer’s Account Opening:

1. The IIFL securities account opening charges can be between INR 00.00 to INR 200.00 for different brokers.

2. To open an account, the IIFL charges as much as INR 1300.00

3. On opening a Demat Account, the customer is bound to pay account maintenance charges, GST, STT, and broker commission.

4. The annual maintenance at IIFL securities is about INR 300.00. The discount broker charges is as low as INR 20.00 and is applicable as and when a trade is executed.

Home Loans Finance Limited Spread of Services:

1. The IIFL company has branched out IIFL Home Finance Limited and Samasta MicroFinance Limited. These institutions issue loans and mortgages to their customers.

2. The company engages in catering to the needs of retail and corporate clients.

3. There are various kinds of loans such as:

- Home loans

- Gold loans

- Business loans including loans against property and medium & small enterprise financing, micro-finance, and capital market finance.

4. IIFL Securities makes a pan-India presence and it stretches across 500 cities and 2,563 branches.

IIFL Vision: The organization aspires to become the most respected financial service company in the country.

Core Values:

- The financial institution is built on three important driving features. They are fairness, integrity, and transparency, FIT. The institution establishes customer relationships only with those who maintain business ethos.

- The company makes a sincere effort to provide sustainable output to its stakeholders. The policies of the IIFL observe the value system in their operations.

- The company conducts its operations in a fair manner and every transaction with stakeholders is authentic. These stakeholders can be employees, customers, communities, regulators, investors, and vendors.

- The company deals in total integrity and honesty with the internal or external public.

- The company maintains its operations completely transparent with stakeholders, investors, and the public.

Web Portal Features:

1. The company on the web portal designs tools that can engage the financial goals of investors in a click.

2. The investor needs to have a single account and one is free to operate equities to IPO to reap maximum benefits in reaching financial goals.

3. The web portal issues smart tools to its users digitally. These smart tools provide endless benefits to investors and they can be listed as follows.

4. It can perform a seamless trading platform, experience recommendations, personalized management services, tools followed by technology, exclusive IPO access, and zero Demat accounts.

IIFL Justifies Six Reasons to Open Free Demat Account:

1. A customer can create a single account and experience seamless service for all investment goals.

2. With a single Customer account, an investor can make investments in equities, futures, options, IPOs, mutual funds, commodities, etc.

3. A Customer can find a hassle-free trading platform. In fact, an IIFL securities Demat account can integrate trading accounts and bank accounts. Such an act shall provide a hassle-free investment and trading investment.

4. IIFL has built-in research professionals and recommendations that prove beneficial to their customers.

5. A Demat account holder can benefit in a huge way from IIFL Securities. It generates research-based reports, and recommendations to enable investors to choose the best investments.

IIFL Securities Features:

1. The securities have an expert professional backup for investors. They offer tailor-made portfolio management services that are in tune with the customer’s risk-bearing capacity.

2. Timely and periodical advice to the investors can monitor and rebalance the portfolio and maximize their goals.

3. The IIFL web portal provides multiple tools such as strategy builder, trading, advanced built-in screeners. All of it to do ease of trading.

4. Another important feature it provides is to apply for an IPO before others can do it. With IIFL, a customer can bid for an IPO before it is listed for a subscription.

Also Check: Tax Benefits for College students

IIFL Securities Opening a Free Demat Account:

- An applicant must fill in the lead form to obtain a Demat account.

- The applicant must enter the PAN and Bank details.

- An applicant must authenticate ‘know Your Customer’ details online.

- The applicant must download the IIFL markets app and then start the investment journey to achieve set goals.

IIFL Login Process:

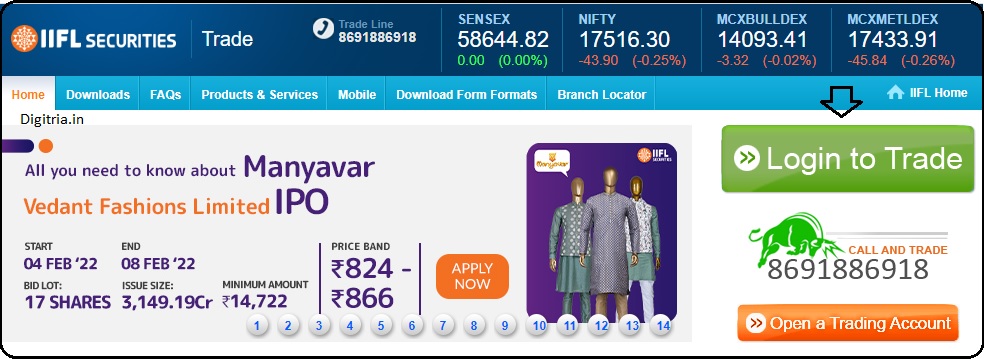

1st step: To log in to the IIFL Securities, Customers should visit the IIFL portal i.e. https://ttweb.indiainfoline.com/.

2nd Step: Tap on the Login to Trade Option shown on the Home page.

3rd Step: Customers will get the trade terminal page. Here, customers must enter the client ID, password, Date of birth, or PAN Number and log in to the trade terminal account by hitting the Login option.

IIFL Markets app Umpteen Benefits in a Single Platform:

1. Every customer after making a Demat account and trading account are advised to have access to IIFL Markets App.

2. The customer can track high-performing stocks on the home screen. The app user can customize and have actionable alerts gainfully.

3. In share markets, one can find two kinds of customers, one being those being fundamental investors. While others are technical players.

4. The smart tools of the IIFL website provide live charts that define 230 plus indicators.

IIFL Securities Brokerage Plan:

Here is the IIFL securities brokerage plan that can give an idea to customers in a meaningful way.

1. The postal charge for the physical dispatch is INR 47.00. Pledge charges (broker margin funding) – INR 25 Including GST.

2. Courier/ Physical printing (when requested) – INR 119.00

3. DP Transaction charge debit – INR 20.00

4. Delayed payment charge (P.A) – 18.25 % System & Risk Square Off – INR 50.00

5. Call & Trade – INR 50.00 Pledge & Unpledge Charges / ISIN (Customer initiated) – INR 25.00

6. Re-pledge and release charges / ISIN (collaterals) – INR 1.00 Pledge Invocation charges – INR 25.00 Re-Issuance of (Additional) New DIS – INR 118.00 (Including GST),

7. Pledge Charges (broker margin funding) – INR 25.00 Including GST, Courier/ Physical Printing (when required) – INR 119.00.

Also Read: NPO Login