Telangana Property Tax Bill for Commercial & Non-Commercial Online Payment will be done through the Commissioner and Director of Municipal Administration (CDMA) website i.e. https://cdma.telangana.gov.in/.

Citizens of Telangana should go through the CDMA portal and Pay the Water Bill, House Tax, and Other Bills. Telangana state People can make Payment of Online Bills like Property tax, water Bills using Online Banking or UPI Payment or other resources.

In the financial year 2020-21, the state govt of TS has given some relaxation from the Property tax. TS IT Minister KTR said that People can pay 50% of house tax for the financial year 2020-21. This Offer will be applicable only once per the Telangana Own householders.

Telangana Property Tax Bill Pay Online Details

There are 2 portals that will help people to pay the Property tax online. One is the GHMC Telangana portal and another one is CDMA Portal. People can make the Telangana (TS) Property Tax Bill for Commercial & Non-Commercial using GHMC or CDMA websites.

The clear information regarding the Property Tax & Online Payment via GHMC or CDMA website is listed below. Beneficiaries must go through the procedure given bottom of the page and Pay the Property tax & Water Tax online. Property Tax will be varied based on the area and Location in Telangana state.

As per the GHMC rules, every Property owner should pay the Tax either Online or offline. But everyone should pay the house tax that is applied to their Property.

All those people who want to pay the Property tax for residential or Commercial offline should visit the nearest Meeseva Centers or Bill Collector Office and complete the tax payment.

Offline Tax Payment Centers:

Citizens can visit the below listed Seva Centers and pay all government bills.

- Meeseva Centers

- Bill Collector Office

- CSC (Citizens Service Centers)

An Overview:

| Name of the Scheme | Telangana (TS) Property Tax Bill Payment |

| Name of the Department | Commissioner and Director of Municipal Administration (CDMA) |

| Official website links | www.cdma.telangana.gov.in or www.ghmc.gov.in |

| Post Category | State govt scheme |

| Name of the Online Bills | Water Bill, Trade License, House Tax |

| Eligible People | Telangana Citizens |

| Mode of Payment | Online |

Also Read: TS Meeseva Portal Folio app

List of Online Services:

- House Tax

- Water Charges

- Vacant Land Tax

- Mutations

- Building Permissions

- Signage License for Advertisement

- Road Cutting Permissions

- Trade Licenses

How to Pay Property Tax (House Tax) Online?

To pay the Property tax online, people should go through the steps elaborated below and pay the bills online.

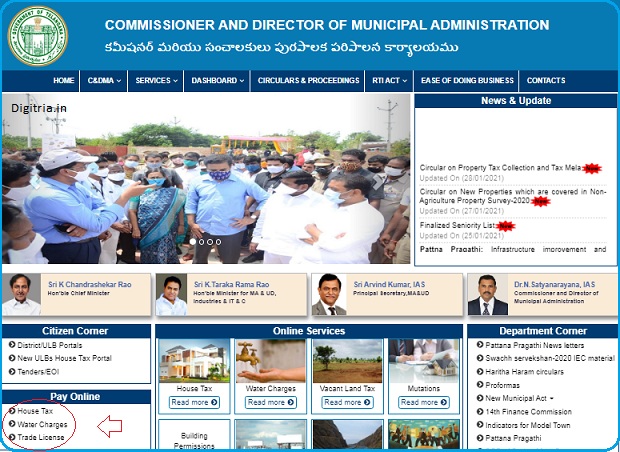

1st Step: First, People must head over the CDMA state govt website i.e. https://cdma.telangana.gov.in/

2nd Step: On the Commissioner and Director of Municipal Administration Home Page, You need to scroll down the page & go through the Pay online Section and click on the House Tax link.

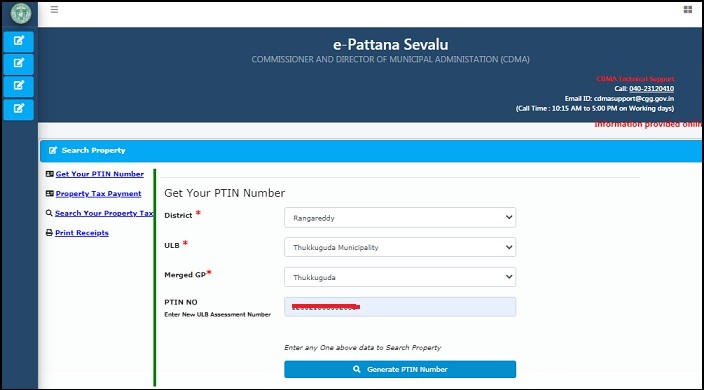

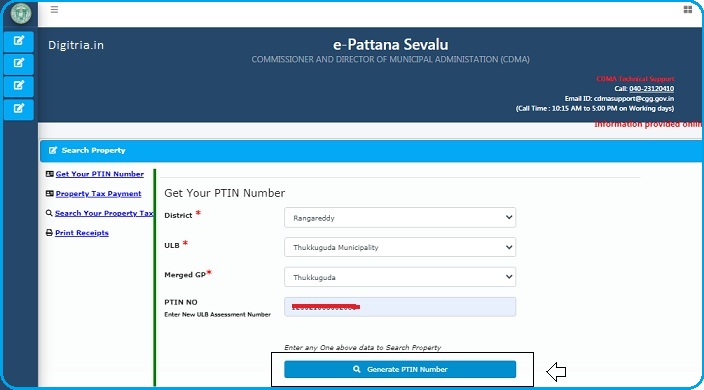

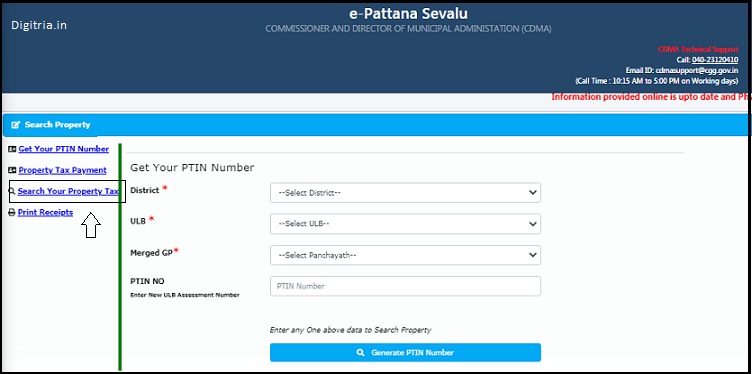

3rd Step: Here, you need to enter the District, ULB, Merged GP, and PTIN number. The cleared figure is shown below.

4th Step: Then, Citizens can click on the Generate PTIN number and Pay the Property Tax Online using Online Netbanking or UPI or Credit Card/ Debit Card.

How to Search TS Property Tax Dues Online?

1st Step: Beneficiaries who want to search their Property tax for Commercial or residential should visit the CDMA website i.e. www.cdma.telangana.gov.in.

2nd Step: Tap the Pay Online section and hit on the House Tax link.

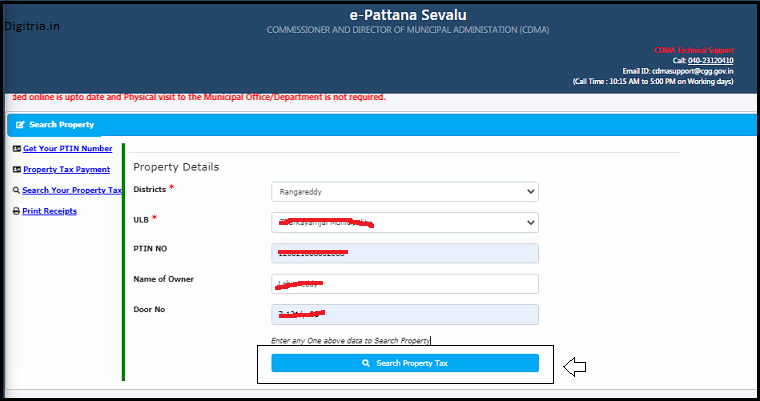

3rd Step: Click on the Search your property Tax link which is placed on the left side of the Home page.

4th Step: Feed the necessary details like District, ULB, PTIN No, Name of the Owner, and Door Number. Then, click on the Search Property Tax Button.

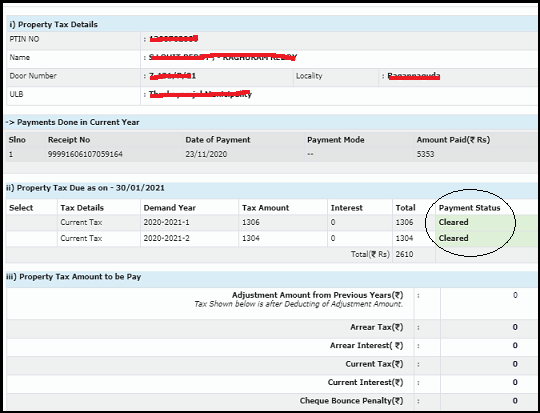

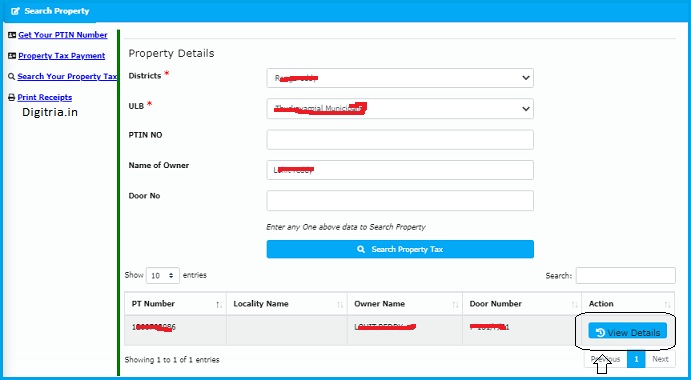

5th Step: Now, you will get the Property Tax details on the display. Here, you need to click on the View Details button.

6th Step: Then, Check Property Tax Status Online.