How to Link Aadhaar with PAN Online: Track Linking Status

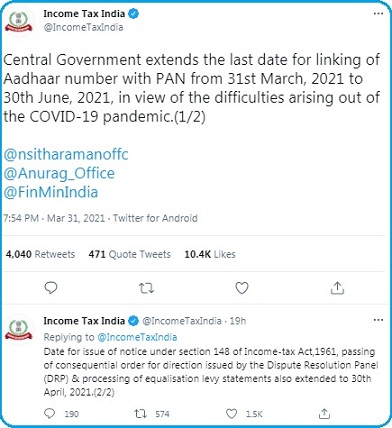

PAN with Aadhaar Linking dates are again extended due to the Covid19 Pandemic. According to the Second wave Coronavirus outbreak, the Central government has circulated the notice to extended the linking of PAN with Aadhar dates.

Finally, the Income Tax of India Department has extended the dates to Link of Adhaar with PAN till 30th June 2021. So, all PAN Card Holders who are not linked their PAN with Aaadhar must link them on or before 30th June 2021. Otherwise, your aadhar card will be deactivated.

If anyone will not link their Aadhar with the PAN card on or before 30th June 2021, the Income-tax Department will automatically deactivate the PAN Cards of the respective people. So, Everyone should link their Aadhar card with PAN Card Number through the official website.

The Complete details about the PAN, Aadhaar Linking Process, track the status of PAN, Aadhar linking, Importance of PAN, Aadhar Linking and etc are given below. Citizens of India can follow the steps elaborated below and complete the Linking Process online.

PAN with Aadhaar Linking Complete details

In the year 2014, the Central government has circulated notice that Aadhar Card is mandatory for all Online and Offline registrations. And, it has suggested to the citizens that everyone should link their Aadhar cards to PAN Card, Bank Accounts, Ration Cards, Voter ID Cards, and any other Identity proofs.

Linking Adhar with PAN is mandatory because Income Tax filing will not be processed if you are unable to link Aadhar with PAN before 30th June 2021.

Important Of Linking:

1. All PAN Cardholders must link the Aadhar with the PAN Card Number thereafter you will not access the Aadhar card.

2. Linking PAN with Aadhar will help in tracking the status of Multiple PAN Cards issued the same name.

3. All Income tax returns will be processed through the Aadhar Card Number.

Income tax India Official Tweet:

An Overview:

| Department Name | Income Tax India |

| Name of the Scheme | PAN with Aadhaar Linking |

| Mode of PAN with Aadhar Linking | Online |

| Official website | https://www.incometaxindiaefiling.gov.in |

| Last date to link | 30th June 2021 |

| Post Category | Central govt Scheme |

| Is it Mandatory | Yes. |

| Eligible Beneficiaries | All PAN Card Holders should Link with Aadhar |

| PAN, Aadhar link Direct link | https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/LinkAadhaarHome.html |

Also Read: Check Aadhar Card Status Online

The Process to Link Aadhaar Card with PAN Card Online:

PAN with Aadhar Card Linking is a Very simple Process. Citizens can go through the following steps listed below and link Adhar with PAN Online.

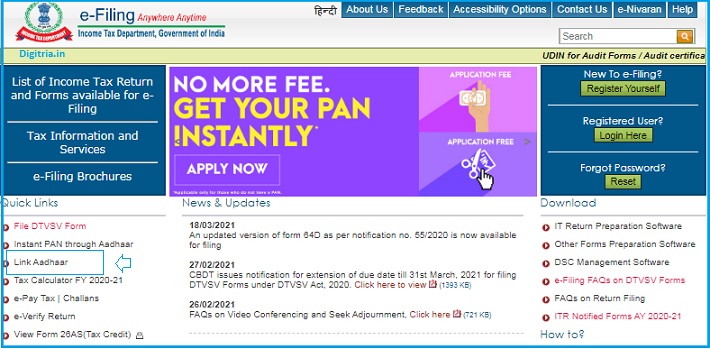

1st Step: All PAN Cardholders must visit the Official website i.e. www.incometaxindiaefiling.gov.in.

2nd Step: On the Income Tax Department e-filing Home Page, citizens can go through the Link Aadhar Option placed in the Quick links section.

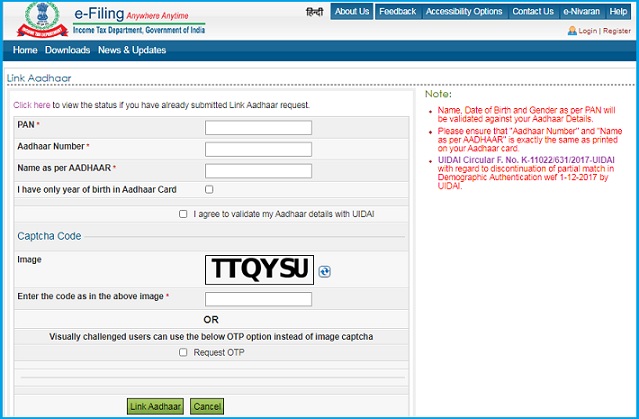

3rd Step: Link Aadhar Application Form will be opened on the Screen. The Formate of the Application is shown below.

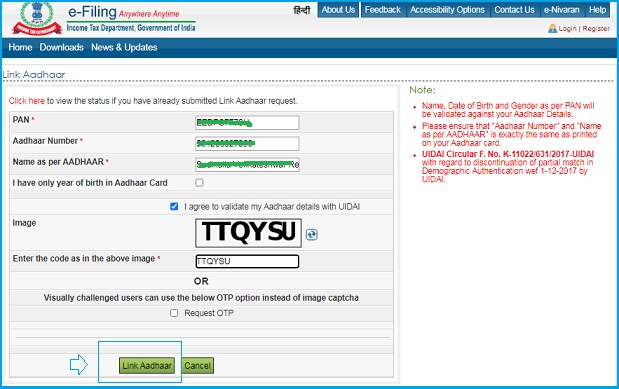

4th Step: Now, Citizens must make sure to provide the 10th digits PAN Number, 12th Digits Aadhar Number, Name as per the Aadhar, Captcha Code and click on the Link Aadhar Button.

5th Step: A new pop-up window will be shown on the screen about the Successful of Linking the Aadhar with a PAN card.

Track linking Status Online:

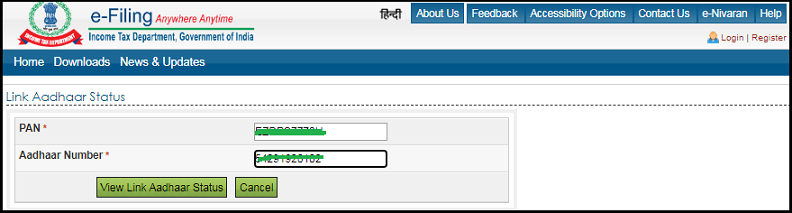

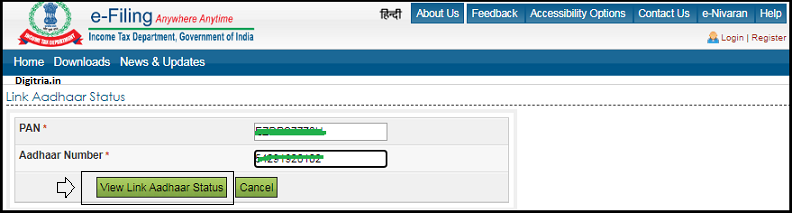

1st Step: To know the status of Aadhar & PAN Linking, people can go through the direct link i.e. https://www1.incometaxindiaefiling.gov.in/e-FilingGS/Services/AadhaarPreloginStatus.html..

2nd Step: Now, you need to enter the 10 digits PAN Number and 12 Digits Valid Aadhar Card Number.

3rd Step: Then, PAN Cardholders should check their Linking status by clicking the View link Aadhar Status button.

Linking Aadhar with PAN via SMS Process:

PAN Cardholders who don’t have Internet access can able to link their Aadhar Card with PAN via SMS.

People should type UIDPAN<12 Digit Aadhaar> <10 Digit PAN> and send them to 567678 or 56161 from the registered mobile Number.

For Example: If your Aadhar Card Number is 322323122314 and your PAN number is EZDPS8880H, you need to type UIDPAN 322323122314 EZDPS8880H and send them either 567678 or 56161.

Frequently Asked Questions:

Q 1: Is it a Compulsory one? What will happen if I do not link Aadhar with PAN?

Answer: Yes. It is a mandatory process. Everyone should link Aadhar with PAN otherwise, the Income-tax dept will close both Aadhar and PAN at a time.

Q 2: What to do If I Unable to Link Aadhar with PAN on or before 30th June 2021?

Answer: The Central Government of India has created it compulsory to linking Aadhar with PAN so that it has extended the dates till 30.06.2021. If you fail to link PAN with Aadhar, the IT Department will deactivate both cards.

Moreover, everyone must make sure to link up both documents through the Income tax e-Filing portal. If you are unable to link Aadhar with PAN, you need to verify the Name on Both Aadhar and PAN Card. If your name is not the same on both cards, people must correct the Name using the Correct PAN Form.

Q 3: What is the Last date to Link Aadhar with PAN online?

Answer: On 31st March 2021, the Income Tax of India has again extended the dates of Aadhar with PAN linking till 30th June 2021.

Q 4: What are the Necessary Details to link Aadhar with PAN online?

Answer: All PAN Cardholders are requested to feed the valid 10 Digits PAN Number and 12 digits Aadhar Number to link Online. There are no other details required to Link PAN with Aadhaar.

Also check: T app Folio Benefits