Federal NetBanking Login: The Federal Bank is highly innovative in designing and implementing features to benefit its customers. Some of them are Lotza UPI app, Lotza MPos, Lotza MPos, Lotza UPos, Scan & Pay.

To detail, they are Lotza UPI app enables Money transfer through nickname for 3 accounts in 3 different banks, Lotza MPos enables Scan the QR code and pay, Lotza UPos machine users merchants to collect their payments at their outlets. Then, Scan & Pay use to Scan the QR Code & pay through your Cell phone.

Corporate Social Responsibility:

CSR in Federal Bank began its operations in an agrarian society. It was one of the first banks to cultivate the banking habits of the rural youth. The bank encourages the utilization of idle money for productive purposes in the rural and remotest areas.

Federal NetBanking Login New User Registration Fednet app

Benefits and Features:

1. Federal bank net banking facilities are ample. A beneficiary (account holder) can transfer funds between accounts owned by oneself.

2. Usually, the beneficiary uses demand draft or cheques as a process of fund transfers. Here, through net banking, the hectic procedures can be eliminated. The fund transfer can happen through IMPS.

3. The beneficiary can make an investment in recurring deposits, fixed deposits, or cash certificates. It can be done from the remotest places such as an office or home.

4. The net banking facility provides a provision to make payment of direct and indirect taxes and the confirmation of payment can be had instantly.

5. The beneficiary should go in for the mobile banking facility while transferring funds to another FB account or to non-Federal bank accounts.

6. The beneficiaries can make payments such as online shopping, loan repayments, mini-statement online, children’s education fees, etc.

Transaction Limitations at FedNet:

Netbanking involves a certain degree of risk while transacting funds between different accounts of the same bank or other banks. To ensure better safety and security of their customers, the Federal Bank sets limits. It is in the case of bank transfers and collects a minimal fee.

1. An account holder can make fund transfers but the banker sets a transaction limit. For fund transfers between own accounts, it is INR 2.0 lakhs, and for non-federal bank accounts, it is a maximum of INR 30,000.00.

2. An account holder can request to enhance the transaction limit, and set a higher transaction limit provided it is put through a request form. The Individual must get into the FedNet, and click on the ‘enhance transaction limit’ which is made available under the ‘request menu.’

3. In net banking, two different schemes run online as they are gold net, silver net. There can be three different kinds of transactions in every scheme. First, transaction limit established to another federal bank account, second, transaction limit established to another bank account or for bill payments, and third online payments.

4. For the Gold Net scheme, the transaction limit to a federal bank account is 10 lakhs, the transaction limit to another bank is 5 lakhs, and other payments are INR 3 lakhs. In a similar manner, for the silver net, the maximum set limit is INR 1.0 lakh for all types of transactions. The service charges for a transaction up to INR 1000.00 is nil, up to INR 1 lakh is INR 5.0, up to 2 lakh is INR 10.00.

Personal Banking / Corporate Banking:

Security Checks:

1. The net banking web portal can be opened only through https://www.fednetbank.com/.

2. A customer must report to the following numbers and should immediately change the password with the help of a toll-free number: 1800 425 1199/1800 420 1199 from within India or +91 484 2630994 from outside India.

3. Do not opt for ‘remember password’ on the computer and do not attempt to agree upon the auto competition option.

4. A customer may receive through email ‘hyper-links’ and it is advised not to attempt such mails. The User ID and password are highly confidential in nature hence it is advised never to share it.

5. Any customer who registers with Federal Bank, then two-factor authentication, 2FA shall be incorporated and it is the case in net banking transactions for additional security.

6. The customer must beware of phishing emails, and never follow any directions provided in a writing format or in the spoken form.

FedNet Registration Important Submissions:

The entire process of registration is digital and a customer need not submit a hard copy at all. However,

1. The customer must be sure in providing the following information to secure a safe registration.

2. The customer should properly mention the account it constitutes: individual, Operation mode single/ either or survivor/ former or survivor/any or survivor.

3. Provide a mobile number that is registered with the saving/current account with the bank’s branch. If the mobile number is incorrect or wrongly enter then it must be immediately informed to the concerned branch.

4. The customer must furnish the right date of birth, ATM card number, and KYC details such as voters ID, Passport No, and PAN card number.

Also Check: FINO Payment Bank Personal Login

Federal Bank Registration:

Customers may opt for different modes of operation such as ‘Single’ or ‘Either or Survivor.’

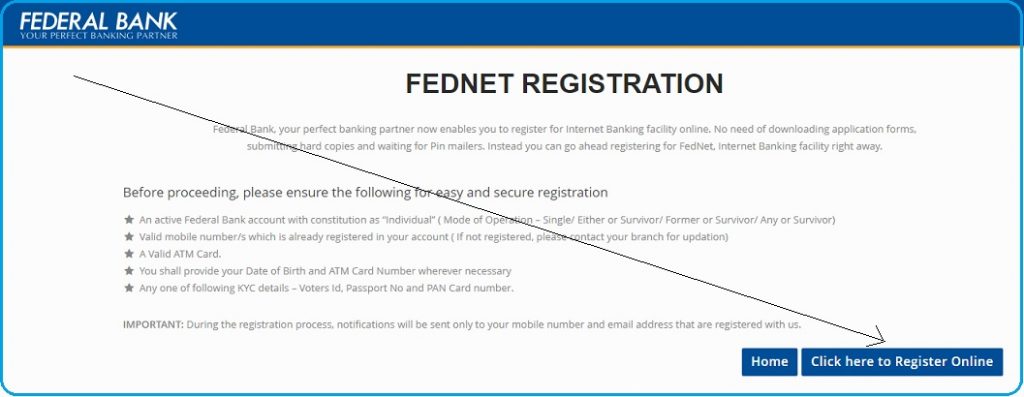

1st Step: To register on the Federal Banking web page, the Customer should visit the Fed Bank official website and hit on the New user link.

2nd Step: The web portal shall drive into the registration page. The customer must tap on the ‘Click here to register online.’ link.

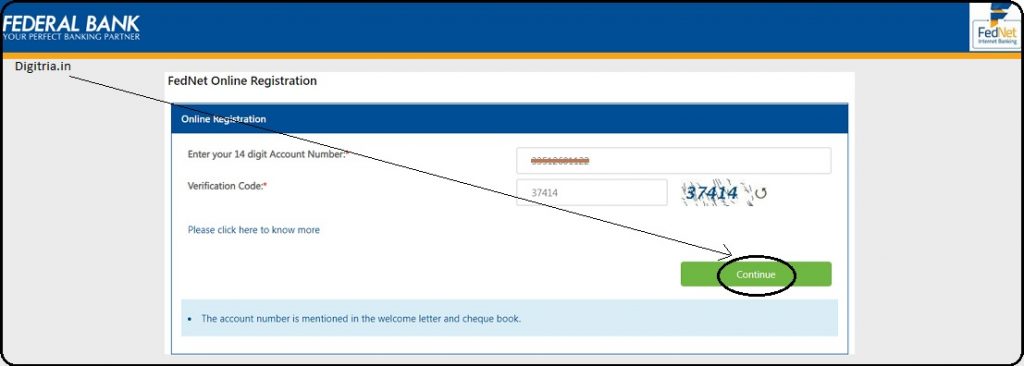

3rd Step: Customers will get the FedNet Online Registration page. Now, Account Holders must enter the valid Account number, verification code displayed on the screen and click on the Continue.

4th Step: The web portal shall deliver an OTP to the registered phone number. The Customer must be typed it in the empty field and click on the validate OTP option.

5th Step: In the end, the customer must Create the New User ID, Password, re-type the password and click on the submit button. It completes the registration for the net banking system.

Federal NetBanking Login Procedure:

1st Step: In order to log in to the Federal NetBanking Login, The account holder must enter the website i.e. www.fednetbank.com,

2nd Step: Go to Personal banking or Corporate Banking Options and view them on the new tab.

3rd Step: The Account Holder will get the Personal banking login page. Customers must enter the User ID, password, Mobile number, verification code and click on the login button.

3rd Step: In case the net banking customer (account holder) forgets their password then here is the simple procedure the net customer must operate.

Federal Bank: Customer’s Password Forgotten:

1. The customer must click on the forgot password? link, and fill in the user details.

2. The customer must enter the User ID, Card Number, ATM pin, expiry date, expiry year, and insert the verification code and then click to continue. Complete the procedure as per the instructions to reset the password.

3. In case, the customer is not clear with the ATM details, then OTP based password setting is possible. If ATM facts are unknown, then click here to set the password.

4. A new web dialog box is on display, and the customer must make an entry of the empty columns. They are user ID, Account Number, mobile number, email ID, verification code, and click to continue button. The customer must follow the instructions accordingly and reset the password accordingly.

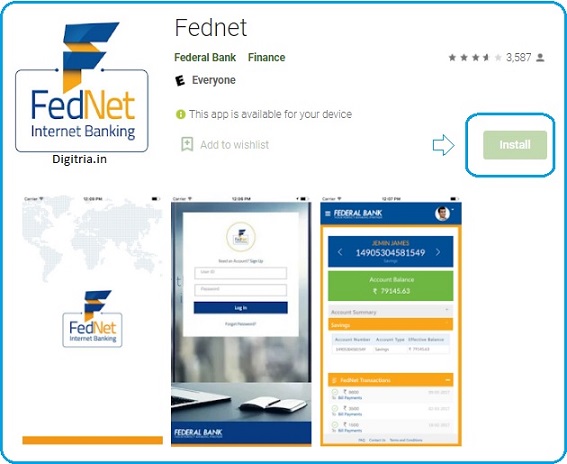

FedNet app download Process:

Customers can User the Federal Banking Services through the FebNet mobile application. To Install the FedNet app, users can go to the google play store direct link and download the app by hitting the Install option.

Also Read: BOI NetBanking Login