Himkosh HP Login Portal e-salary eChallan Taxpayers Register apps Online

Himkosh HP Login Portal – User-centric Portal: The Government of Himachal Pradesh has launched a web portal to serve the purpose of government employees and the citizens of Himachal Pradesh. It is run by the State Finance Department. The services are extended in the areas of salaries, pensions, vitran, challan, Kosh, etc. The entire operations of the Himkosh Portal are user-centric and the features are extremely simple to use.

The official website is https//Himkosh.nic.in. The Himkosh HP Login portal is developed on the IFMIS and is designed & devised by NIC. It is abbreviated as National Information Centre that is located in Pune. In a similar manner, the Himachal Pradesh government launches official apps to suit the purpose of mobile users. The apps can be easily installed and downloaded from the play store.

Himkosh HP Login e-salary eChallan Taxpayers Register Details:

Portal Benefits:

1. The portal can be operated from anywhere, anytime and this saves time and energy.

2. It reduces scouting government offices.

3. The entire operations go online, and it saves paperwork.

4. The web portal provides services on Himkosh and they belong to eight different areas of operations.

5. The services are e-Salary involved in the preparation of salary bills, ePension in online pension processing. Likewise, eVitran enables efficient online budget disbursement, eChallan involves GoHP receipts online. In addition, eKosh reports financials online, HPNPS, new pension scheme MIS, AGHP-VLC. Moreover, electronic transfer of VLC data, and HPOLTIS, details

The objective of Himkosh:

1. The basic objective of the HIMKOSH is to support issues of finance payments by the general public and the government employees.

2. The government of Himachal Pradesh, provides an e-payment facility to citizens who can pay fees and taxes online directly.

The simple process for e-payment via the Himkosh portal:

1. The taxpayers of Himachal Pradesh should have to select the department and DDO which is applicable.

2. In the online application, the taxpayer must make an entry of a department reference number or any other unique number. For instance, in the dept. of transport or excise and taxation, vehicle registration number for transport, TIN for excise, and taxation is taken into account.

3. Certain important fields of the challan comprise accounting head, address of the taxpayer, payment is done for a specific scheme. Make a selection of the bank through which the payment is processed.

4. After submitting the data, a confirmation screen will pop up. The page gets redirected to the Net banking on confirming.

5. If the process of payment is through net banking, the user will get login credentials from the bank. The payment details are entered and on the confirmation, the amount gets credited to the concerned dept.

6. On completion of the payment, the challan counterfoil will be on display. It contains the transaction details such as CIN number, payment details, bank name, payee returns to eChallan portal. The receipt of the challan is delivered to the registered email and the details of the challan are password protected.

eChallan Payment for Registered Users:

1. The taxpayer must enter the official eChallan portal.

2. The taxpayer must declare a valid email id when filling the application form, along with correct login details and personal details.

3. The eChallan payment system delivers a verification link to cross verify the registered user details.

4. Taxpayers must enter the eChallan Payment Site, by entering the login credentials.

5. Taxpayers can update their profile or can even make changes in the password.

6. Click Add Services from My Service and enter Manage Service.

7. Taxpayers must choose the department, and enter the service, and DDO.

8. To make the challan payment, select the specific service in the ‘Account.’ After submitting the challan details, the data is transferred to the select bank portal, from where the challan payment is to be made.

9. On making payment through the net banking system, the status of the transaction is displayed on the eChallan Portal.

Registered Taxpayers: Advantages:

1. The net portal provides users with the facility to make payments of multiple services in favor of the same DDO.

2. The list of payments can be created as a profile that can be viewed or downloaded when necessary.

3. A list of banks who are listed by the government are readily made available on the site for taxpayers’ reference.

An Overview:

| Name of the Portal | Himkosh HP e-salary eChallan |

| Portal Launched by | Government of Himachal Pradesh |

| Department Name | IFMS HP State Finance Department |

| State govt | Himachal Pradesh |

| Programme Name | Himkosh HP Login |

| Category of the Post | State govt Programme |

| Official website | https://himkosh.nic.in/ |

Also Check: National Career Service Registration

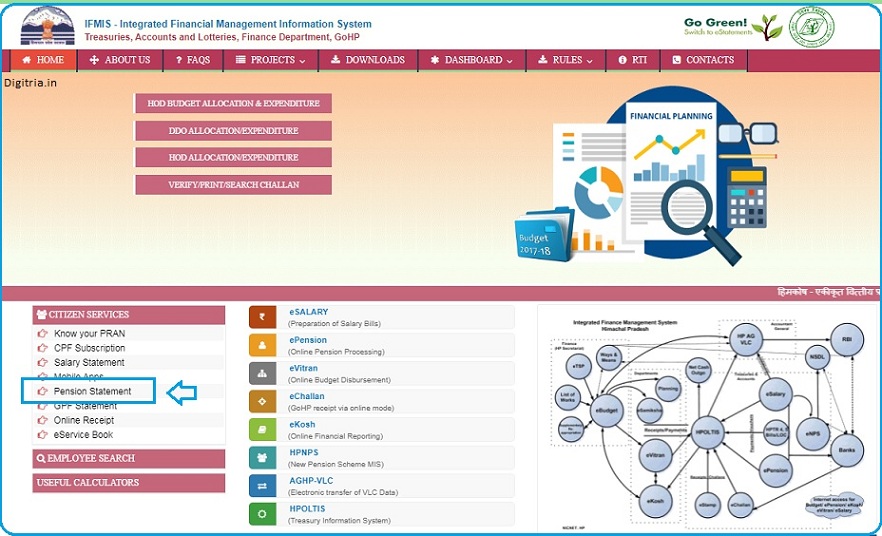

The Process to get the Pension Statement via Himkosh Portal:

1st Step: To get the Pension Statement, beneficiaries should visit the Himkosh website i.e. https://himkosh.nic.in/.

2nd Step: On the Home Page of IFMS HP Finance Department, Beneficiaries should scroll down the page and click on the Pension Statement Option.

3rd Step: The page will redirect to the HP Pensioners official website. The link of the HP Pensioners is https://himkosh.hp.nic.in/treasuryportal/epension/epensionkhoj.asp.

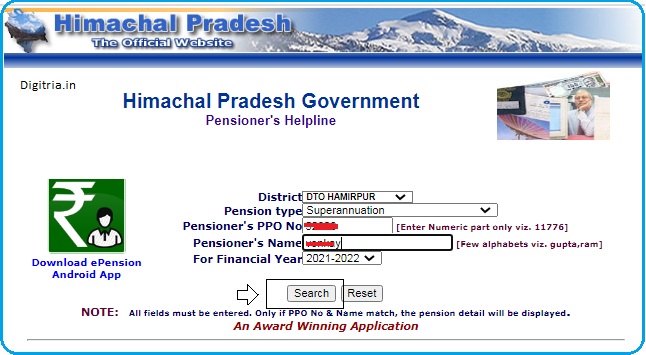

4th Step: Beneficiaries should select the district, Pension Type, Pensioner’s PPO No, Pensioner’s Name, For Financial Year and get the statement Pension by hitting the search button.

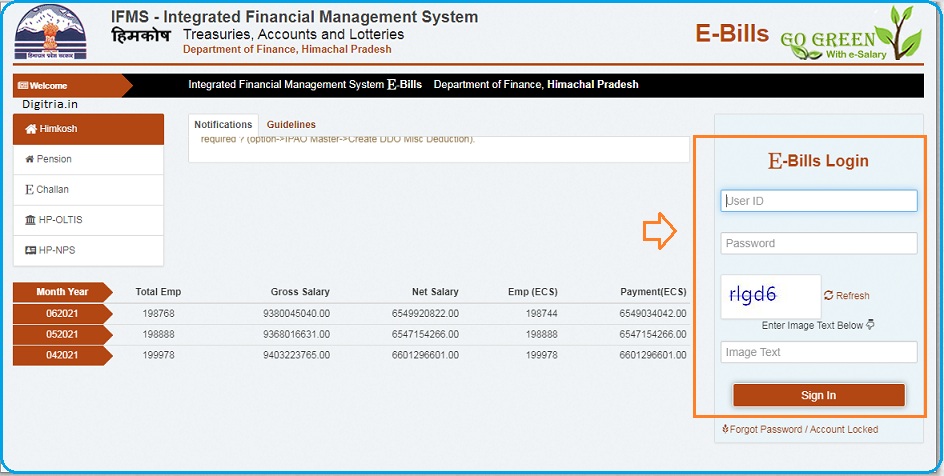

Himkosh HP Login for e-salary:

1st Step: To log in to the Himkosh HP for e-salary, employees should visit the direct link i.e. https://himkosh.nic.in/eSalary/Account/Login.aspx?ReturnUrl=%2Fesalary%2F.

2nd Step: Check the e-bill Login section placed on the right side of the Home page and enter the User ID and Password.

3rd Step: And, next employees should enter the captcha code and check the e-salary details by a sign on the page.

Also Read: Upadi Hami Pathakam check HP balance amount