PM Jan Dhan Yojana Apply Online 2022 Beneficiary List Check PMJDY Status

PM Jan Dhan Yojana Status: The Indian Government Prime Minister Narendra Modi Garu has recently initiated the scheme namely PM Garib Kalyan Yojana (PMGKY) for Indian women Beneficiaries and started to deposit Rs.500 for the next three months. PMGKY scheme amount was deposited into the PMGKY cardholders on 1st April 2020.

In the same way, the PM Kisan yojana scheme amount of Rs.2000 also deposited into the accounts of the former on 1st April 2020. Now the PM Modi Garu has come up with a new scheme called Pradhan Mantri Jan Dhan Yojana (PMJDY) to offer more benefits for these lockdown days.

The PMJDY scheme was launched by the government of India to provide more benefits to the Indian Poor and economically backward people through this scheme. Once the beneficiaries will open the PMJDY account automatically all benefits will be added to their account.

PM Jan Dhan Yojana Status 2022 Beneficiaries List Details

The PMJDY account is a free account and the People no need to maintain sufficient balance on this account. Because this is a Zero Balance Account. After opening this account beneficiaries will get accidental Insurance and overdraft facility automatically.

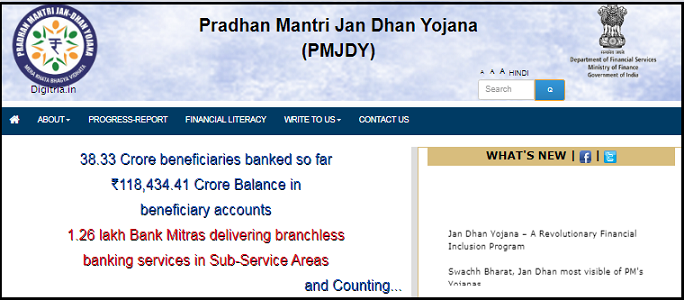

According to the recent survey, more than 33 Crore Indian people open the PM Jan Dhan Free account and also deposited one lakh forty thousand crore amount in these accounts.

The Honorable Prime Minister Narendra Modi Garu has introduced this scheme in August 2014. Under this scheme, the government provides free bank accounts to all household beneficiaries.

In this article, we have mentioned the PM Jan Dhan Yojana scheme complete details like eligibility, required documents, How to open PM Jan Dhan Yojana (PMJDY) online account, Benefits, and process to check the status of the PMJDY Scheme. So the Interested Beneficiaries can follow the instructions mentioned below and open the Jan Dhan account.

Latest News: Due to the Coronavirus Crises, the Indian government has initiated the new rules in India to fight against COVID-19, and also the lockdown system was implemented by the Indian govt till April 14, 2020. So that it has started more new schemes to provide the food and other daily needs commodities to the wage workers and poor people. The Financial Department has released 1.7 lakh Crore to help the Poor people in lockdown days.

Eligibility:

1. All category Beneficiaries are eligible to open the PM Jan Dhan Yojana account.

2. The Beneficiary’s age should be above 35 years to avail of these benefits.

3. The applicant’s family annual income must be less than 3 lakhs.

4. Applicants must have an Aadhar card and ration card issued by the state or Central government.

Benefits of PMGKY Account:

1. It is a Zero Balance account.

2. Applicants will get an interest amount every six months.

3. Beneficiaries should not maintain balance in this account.

4. Applicants can transfer amounts throughout Indian to any bank as well as any person.

5. Beneficiaries will obtain life insurance coverage up to Rs.2 lakhs. Immediate death insurance is Rs.30000.

6. The overdraft facility is also available up to Rs.10000 per each lady’s household account.

Overview:

| Scheme Name | PMGKY Scheme |

| Type of Scheme | Central Government Scheme |

| Scheme Initiated by | PM Narendra Modi Garu |

| Name of the Department | Ministry of Finance Services (MFS) |

| Number of Beneficiaries opened accounts under PMGKY Scheme | 38.33 Crore Beneficiaries |

| Balance in Beneficiaries accounts | Rs. 118,434.41 Crore |

| Post Category | Scheme |

| Official website | www.pmjdy.gov.in |

Name of the Schemes works under the PMGKY Scheme:

Pradhanmantri Jeevan Jyoti Bima Yojana (PMJJBY): Under this scheme, beneficiaries will get up to 2 lakh accidental Insurance. The money will be charged from the beneficiaries is Rs 330/- per year.

Pradhanmantri Suraksha Bima Yojana (PMSBY): Under this scheme, People will get up to 2 lakh accidental Insurance. The amount that will be deducted from the beneficiary’s account is Rs 12/- per year.

Atal Pension Yojana (APY): Under this scheme, beneficiaries will get a pension amount of Rs.1000 to Rs.5000 based on the applicant’s category.

Pradhanmantri Mudra Yojana (PMMY): Under this scheme, beneficiaries will get bank loans up to 10 lakhs for Small Scale Industries and other businesses.

Required Document to open the Bank account under PMJDY scheme:

- Copy of Aadhar Card to recognize the Citizen of India.

- Copy of PAN Card

- Photo of the applicant

- Address Proof Document.

- PWD Certificate

- Voter ID Card issued by the ECI

- The gazetted officer issued a Letter

How to open an account under the PMJDY scheme?

1st Step: Beneficiaries who want to open a bank account under this scheme must reach the nearest private or Public bank Sector.

2nd Step: And ask for a new application form under the PMJDY Scheme. Take the bank account application form as well as the PMJDY Scheme application form.

3rd Step: Applicants can fill up the details and attach the documents mentioned above.

4th Step: Finally Submit your application form to the bank officer.

5th Step: Your bank account under this scheme will be active within 24 hours and also the bank account number will be sent to your registered mobile number.

Mahoday

Scheme achhi hai

Par vargikaran karke kewal vote ki

Chinta hai aplogo ka bhi

Kya kisi jati ka madhyam pariwar jo

5 se 10 ekad tand land rakhta hai

Uska incom itna hai gav me jaha na

Bijali hai na kheti ke liye pani

Fir inlogo ko bhookh nahi

Kya ye ameer ho gaye

Istarah ka barfi karan congress karti

Thi to apologize me kya anter raha

Gav me ghar aur family ko unit manegi byakti byakti kabhi kuchh

Suvidha pura nahi hoga

Manrega se har gav me kewal

Bina vargikaran aur tustikaran se

Talab banaiye nigrani ke sath.

Madhyam barg pariwar hi adhar

Hai apka jo gusse me hai.

Kyu unko jati aur ameer ke name

Par har sarakar chalti hai

Aap log bhi wahi kar rahe vote par