Vidyalakshmi Portal Education Loan SBI Login 2022 Registration Application Form

Vidyalakshmi Portal: The government of India has introduced an education loan online over the Vidya Lakshmi Portal www.vidyalakshmi.co.in that is associated with different banks across India to provide financial support to students.

The department of Higher education under the Ministry of Human Resources (MHRD) ensures that the IBA provides educational loans to the deserving at an affordable rate of interest.’ The banking sector in India under the guidelines of the government of India issues education loans and different amounts of loans are categorized and released.

Vidyalakshmi Portal 2022 Education Loan Login, Registration:

Not to begin with a negative note, certain observations do state the fall in the performance of the education loan under the VidyaLakshmi Education loan. First observation, the banks began to record huge amounts of Non-Performing Assets (NPA), particularly under the INR 4 lakh category. Basically, the loans are issued based on different criteria such as courses, institutions, or students.

The RBI reported that the NPA hovered at 5 percent and the educational loan rose by 9.1 percent to INR 65,335 in March-end 2016. The growth rate steadily declined to 2.9 percent on March-end 2020 to INR 72,891 crore and further, it declined to 1.5 percent to INR 73,977 crore in December-end 2020.

The National Educational Policy 2020 in July that year released the Central and State expenditure on education in India. It was about 4.43 percent of GDP to 6.0 percent and besides educational loans to Indian students in India and abroad even students from foreign are invited to pursue their technology and management courses.

These students are given the opportunity to step into reputed institutions such as IITs/ IIMs/ IISc/ XLRI. A banking expert Viswanathan explains the significance of revamped loan schemes for meritorious students of the NRI/ PIO/ OCI category. The inclusion of bank loans and opportunities for foreign students in the Indian scenario can improve the international ranking drastically. The students of Indian origin are allowed to gear up their education into at least 100 universities.

Condition for NRI/ PIO/ OCI Students:

1. With the new scheme in implementation, the co-applicant must be a permanent resident of India when the students belong to NRI/PIO/OCI.

2. The lack of credit history for students will make the banks extend the repayment holiday and also alleviate the student loan amount when applied for.

Indian Banks Association (IBA) Loans:

1. The Model Education Loan Scheme provides a loan of Rs.10,00,000 for students who are opting for higher studies in India while those who select abroad shall receive INR 20,000,00.

2. For these kinds of loans, a student must obtain collateral security from a Parent/ guardian and in addition, collateral security from a guarantor.

3. Another kind of loan are collateral-free loans Rs.7,50,000 under Credit Guarantee Fund Scheme for Education Loans (CGFSEL) and the repayment of education loan can be scheduled for 15 years.

Also read: CBI Netbanking Login

Benefits of Education Loan to Beneficiaries:

1. The interest that is applied on the loan is simple interest. Hence the loan will not accumulate huge amounts while making repayments. The scheme provides a 0.5 percent concession in the interest rate to the girl students.

2. The income tax department provides a one percent concession on the interest paid from the inception of the interest on the loan amount and the moratorium period until the commencement of loan repayment.

3. The moratorium period is for 1 year and for start-ups a certain period is likely to be extended.

4. From 1st April 2009, the IBSA began to consider the students of economically weaker sections by providing an interest subsidy scheme. The loan recipient shall obtain a loan amount up to INR 7,50,000 and no interest is levied during the moratorium period.

Eligibility criteria for Vidya Lakshmi loan:

1. The Family’s annual income of the student must not be more than INR 4,50,000 per annum.

2. Students who are pursuing education in NAAC and NBA accredited institutions are eligible for the education loan. The institutions must be of national significance or centrally funded technical institutions.

Vidya Lakshmi Registration Process:

1. The applicant must visit the Vidya Lakshmi web portal www.vidyalakshmi.co.in or https://www.vidyalakshmi.co.in/Students/signup.

2. On the home page, applicants should click the ‘Register’ tab.

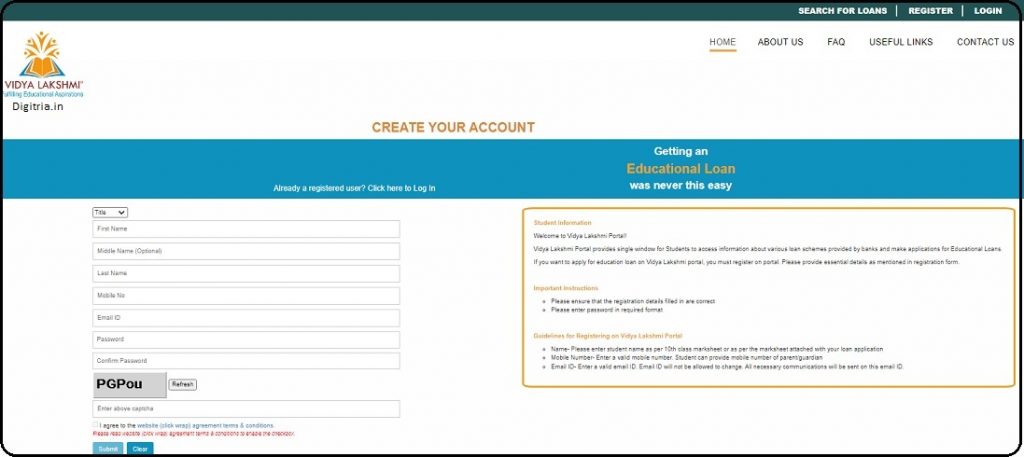

3. Once you get the Create your account page, applicants must fulfill the details like name, mobile number, email id. Go through the terms and conditions and click on the submit button.

4. The web portal shall forward the activation link to the applicant’s registered email id. The applicant must click on the link to activate the account.

Vidya Lakshmi Student Portal Login Process:

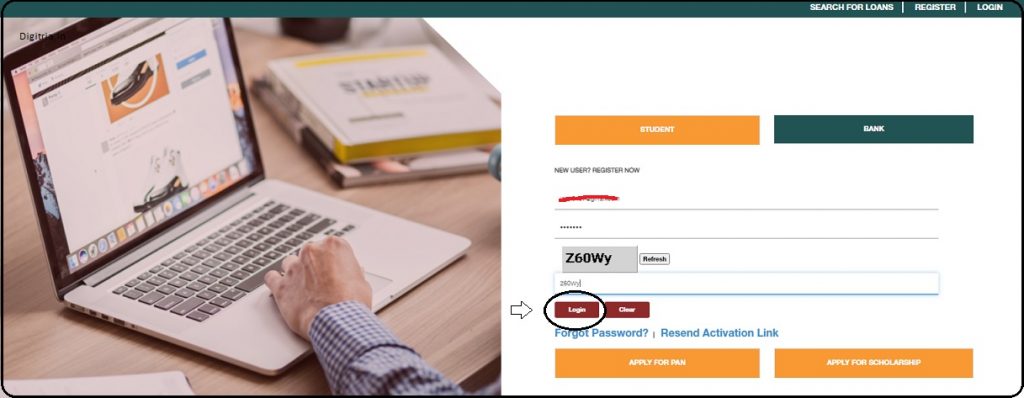

The applicant after registration shall get the login credentials and they must be entered in the login module page. Another option is an applicant can make a direct login through a link.

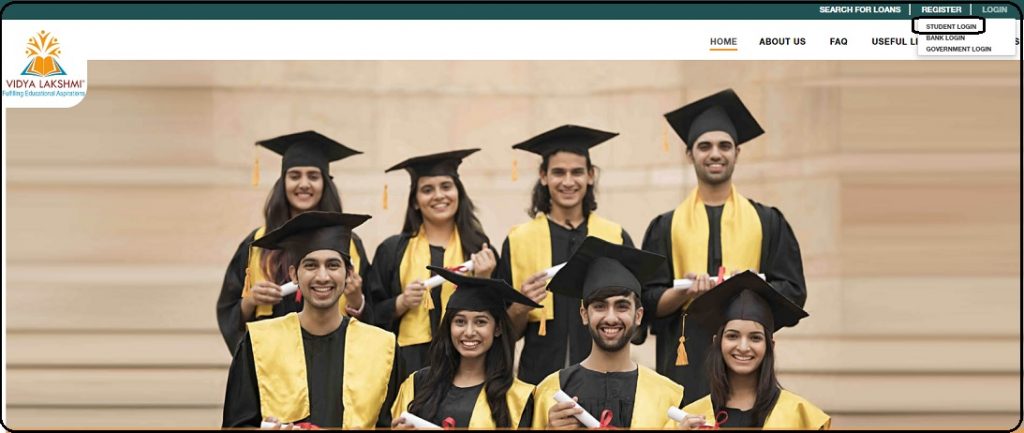

1. The applicant must open the official website and tap on the login option.

2. Applicants will get three options on the computer screen. They are Student Login, bank Login, and government Login. Applicants must select the Student Login and view the page on the fresh tab.

2. The applicant must enter the email id, password and apply for the education login by login the page.

Also Read: Vidyasagar Shishu Niketan Student Login