ESIC Gateway Login 2024 Registration app, Pay e-Challan

ESIC Gateway Login: In the Constitution, section 2 (12) refers to the ESI act that states, the Employee State Insurance Corporation (ESIC) scheme is applicable to the non-seasonal factory, and establishments. Following entrepreneurs such as restaurants, hotels, shops, newspapers, cinemas, and road motor transport undertakings, establishments do come under ESIC. From August 1, 2015, the construction workers at working sites were included in the ESI schemes.

ESIC Gateway Login 2024 Employer State Insurance Portal:

Features of ESI scheme:

The employer makes payment of the Employee State Insurance scheme through online processes. Usually, the employer must deposit the amount @ the authorized bank no later than 15 days from the last day of the month. The employer adds his contribution to the wage of the employee and deposits provided the daily average wage is INR 137.00.

Compliances:

- An employer should follow the required rules and regulations laid by the ESI. After signing up with the ESI, every employer must comply with the assigned compliances.

- The employer must maintain an attendance register and keep an updated record of the worker’s wages.

- The ESI lays down procedures to inspect the work on-premises and employers must follow it without a miss.

- An occurrence of an accident in the premises of work if any must be put in writing in a register book.

Employers Submissions at the ESI Office:

- Employers must file ESI on a half-yearly basis, provide Form 06, and also register for ESI return filing.

- Employers are also required to file ESI on a half-yearly basis.

- Every employer must submit a monthly return challan within the 15th of the upcoming month.

Manpower/ wage limitations for Availing financial benefits:

- For the employees of a company, can avail the benefits provided at least 10 and more of them are employed under an employer.

- The basic wage limit of the employees/beneficiaries should be up to 21,000 per month.

- An employee with disabilities should have a wage limit of Rs.25,000 per month.

Employer & Employees Contribution: The ESIC contribution rates are in this manner, the employer contribution is 3.25 percent, the employee contribution is 0.75 percent and the total contribution comes to 4 percent.

ESIC Registration Compulsory Documents Submission:

- The employer can make online registration at ESIC but will have to submit documents at the registration center.

- The employer must submit the employee’s following details, and they are like this: Pan Card Copies, and bank statement copies.

- In addition, the license issues under any of the acts, such as the shops & statement act, or factories act, bank statement copy. Moreover, proof of address, rental receipt of the occupied premises, the latest copy of the latest building tax receipt. The employer must submit the company’s registration certificate and registered number of CST/ ST/ GST. The employer must open a list of directors and shareholders of the company if any.

- The employer may hold a company, a partnership deed, or a trust deed. In any case, one must attach the copies of memorandum and articles of association.

- The employer must keep submitting the monthly attendance details to the employees at the ESIC. In addition, the employer must submit the pay sheet details of employees enrolled with the ESIC to reap the health insurance/ medical benefits.

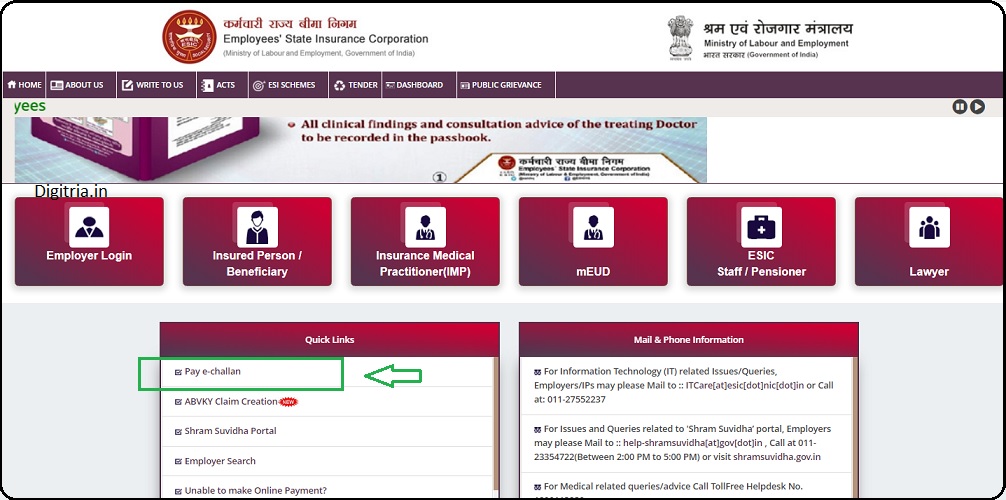

E-challan Payment Module:

1st step: The employer must enter the web portal at https://www.esic.in/ESICInsurance1/ESICInsurancePortal/PortalLogin.aspx#headpara and then click on the pay e-challan link at the quick links dialogue box.

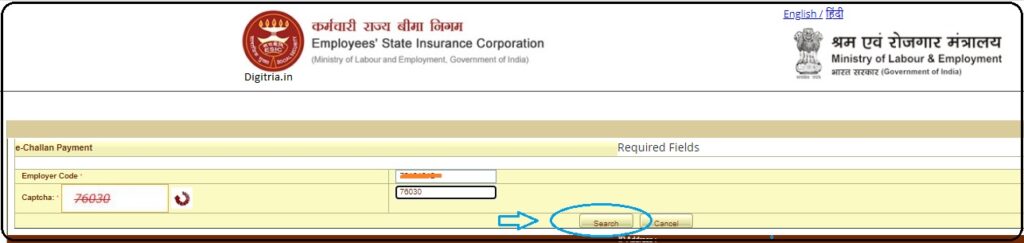

2nd Step: The ESIC web portal shall direct to a new web page, known as the ‘e-challan payment’.

3rd Step: The employer should enter the employer code, and captcha in the fields and click on the search button.

4th Step: An employer is expected to fill in the details from the list and select the challan for which the remittance is to be done.

5th Step: After selecting the challan, you will get the employer code, employer address, challan number, challan period, and the amount shall be on display.

6th step: The employee must proceed to render the payment by clicking the challan number link and clicking ‘continue.’

7th Step: The web portal shall direct the employee to the ESIC e-payment gateway. Then, one must decide upon a mode of payment, debit card, net banking, etc.

8th Step: The web portal shall display the transaction details of the e-challan payment once it is complete.

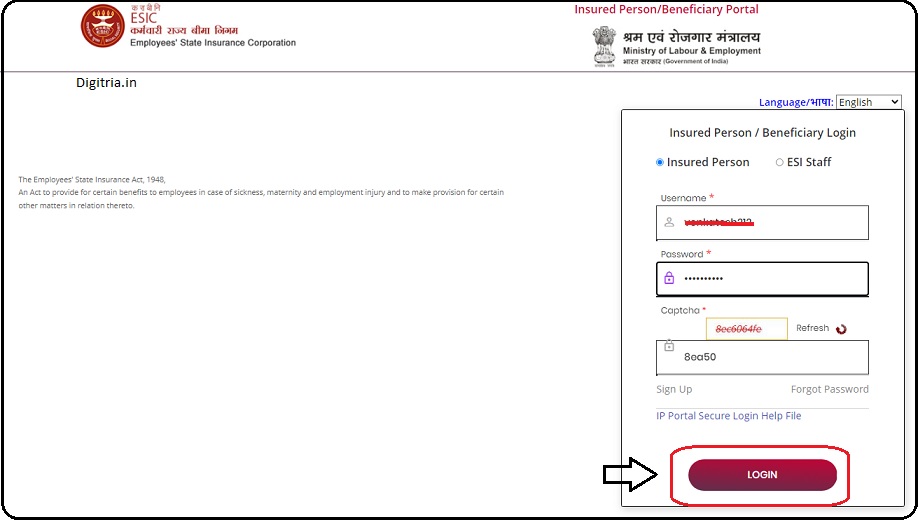

Steps to Login by Employees at ESIC:

An employer must get the employee insured with ESI, and then the procedure to make an easy login is shown.

1st step: The employee must enter the homepage of the ESIC login portal and click the link ‘Insured person/ beneficiary” Option.

3rd Step: The employee will get the Insured Person/ Beneficiary Login page. The Employee should enter the User Name, Password, and Captcha and log in to the Insured Person page.

4th Step: Similarly, the ESIC Staff should follow the same procedure and log in to the ESIC Staff Login page

Also Check: e-Shram Portal 2023 Login

forgot password:

- In case an employee forgets the user password. One must click the link, forgot password, on the employee login page. It will lead to a ‘forgot password’ page.

- Enter the details of insurance number, and mobile number, and click the submit button. One can find the details on the mobile number.

- The employee must follow the instructions accordingly to seek a new password.

Employee State Insurance Scheme (Benefits & Features):

The employee’s state insurance scheme is a self-financing scheme and can be dealt with in two ways: Cash benefits, and non-cash benefits.

Non-cash Benefits:

- In case of non-cash benefits the ESI provides medical care and the salient features are in this manner.

- ESI covers the medical expenses of family members and the insured employee from the 1st day of employment.

Cash Benefits:

ESI Scheme supports employees with cash to cover sickness, maternity, disablement, vocational rehabilitation, and funeral expenses.

- An employee is entitled to 70 percent of the wage if one has fallen sick for a period of up to 91 days in a year.

- An employee can avail full wage for 26 weeks and further for another one month if the doctor certifies it.

- An employee is eligible to avail 90 percent of the wage until one overcomes the temporary disablement.

- In case an employee faces permanent disablement, one gets 90 percent of the salary.

- 50 percent of the wage for a period of 2 years if the closure is due to factory, retrenchment, or establishment.

- Financial aid in the form of a monthly payment of 90% of the wage to the dependents if the insured person demises.

Also Read: ESIC IP Portal Login

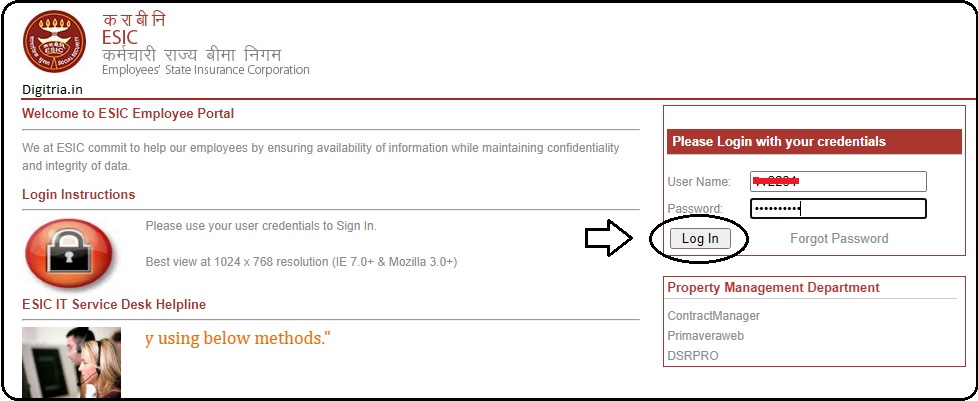

ESIC Gateway Login Process:

1st step: In order to log in to the ESIC GATEWAY Login, employees should visit the link i.e. https://gateway.esic.in/opensso/UI/Login?realm=internal.

2nd Step: On the ESIC employee portal, employees can provide the login credentials like User name, and password, and log in to the page.

Also Check: ESIC TRRN Status 2023