Kerala GPF Annual Statement 2021-2022 Check Temporary Advance

Kerala GPF Login: A Kerala employee be it permanent or temporary in nature can obtain Advances from the General Provident Fund (GPF) and for which the employee (subscriber) will have to fulfil certain terms and conditions. The following paragraphs describe them in detail. For that matter, every employee of the Kerala government must register online and apply through their login credentials.

Kerala GPF Login 2021 Statement, Salary Slip 2021 Details:

Eligibility Details:

The following categories of Kerala state govt staff are eligible to join the Fund:

1. The employees of Kerala who belong to pensionable services can enrol for GPF.

2. Employees who are enrolled in services and undergo probationers are allowed for GPF after completion of their probation period.

3. Employees of any service (temporary, acting, or officiating members) except re-employed pensioners are eligible for GPF on completion of their continuous service.

Kerala Payslip / KSEMP GPF Login Process:

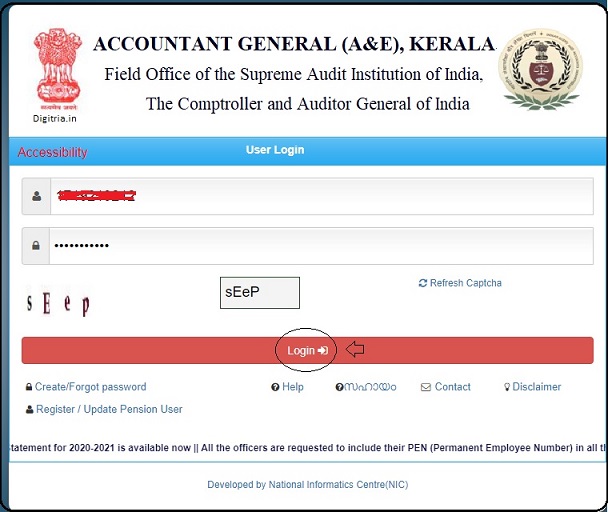

1. To obtain the Kerala Payslip / monthly salary slip, the employee (subscriber) must enter the website portal: ksemp.agker.cag.gov.in/Login and click on the search button.

2. The employee must enter the login portal and enter the Permanent Employee Number (PEN) or DDO or PPO or Treasury ID or Spark ID and password. Then, the employee must enter the Captcha code and click on the login button.

3. The web portal shall open the GPF and the Salary details on the concerned page.

Also Check: SPARK Login

Download KSEMP Annual Statement at GPF portal:

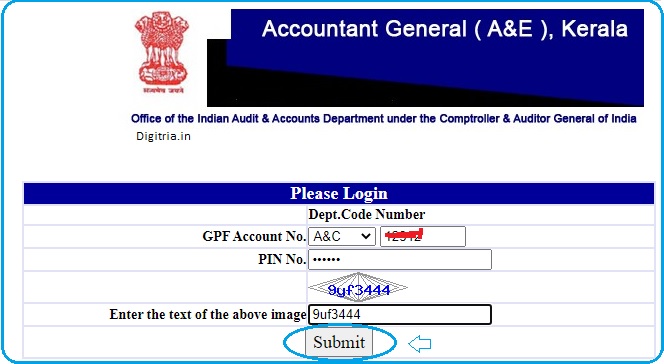

1. To download the annual Statement of the KSEMP via the GPF website, employees should meet the official website i.e. http://pagkerfts.cag.gov.in/login.php?&task=GPF

2. The web portal shall open a new GPF login page. The employee must enter the concerned department, GPF number, PIN number, captcha code to proceed and select the submit button to complete the process.

4. It will display the GPF details and an employee can view GPF details of their desired year.

Advances from the Fund:

I. Temporary Advance: Employees of Kerala will get the temporary advance from the respective departmental officers for specific purposes. The credit is drawn from an accumulated fund. The Accountant General has set a monetary limit and the respective departments have authority to issue temporary advances up to 75% of the accumulated General Provident Fund, GPF.

Another arithmetic calculation is (3a-b)/ 4 (a = balance at credit, b= amount of consolidated advance outstanding) whichever stands less.

2. In case of the part-time contingent employees the temporary advance disbursement shall not exceed the 16 months accumulated General Provident Fund, or half the amount at credit. The concerned department shall decide on whichever amount is less on calculation. The department makes a note of the temporary advances in the employee’s account when subscribed for the General Provident Fund, GPF. The concerned department provides temporary advances when a part-time contingent applies in Form B.

Conditions for a Sanction of Temporary Advance:

1. All employees are eligible to register for the temporary advance provided there is at least a gap of 6 months between the withdrawal of 2 temporary advances.

2. A temporary advance taken on the basis of a non-refundable advance should have a gap of four months although for the same purpose.

3. The temporary advance is not sanctioned during the last three months of the service.

4. The employee (subscriber) of the GPF will not be sanctioned with temporary advance during the period an employee proceeds on leave preparatory to retirement.

5. An employee may quit the fund and further move out of the fund then the subscriber is not entitled for the sanctioning of the General Provident Fund.

6. An employee may not have subscribed to the fund for a specific period and during leave without allowances, the department shall not provide a temporary advance.

Temporary Advance Recovery:

1. The employers to the GPF must make repayment of the temporary advance in equal monthly instalments. For a regular employee, it must be somewhere between 12 months to 36 months. For the part-time contingent employees, the repaying period must be between 15 months and 30 months.

2. If an employee is making a repayment of the advance and applies for a second advance then the department may sanction a temporary advance. In such circumstances, the balance advance repayment and fresh advance is summed up. The consolidated amount shall be distributed equally on a number of paying terms and the temporary advance shall be recovered accordingly.

3. The employee (subscriber) shall have to begin with the repayments of temporary advance from the next month of the temporary advance made. A subscriber can make repayments in two or more instalments in a month.

Constitution of the Fund:

1. Initially, the GPF came into existence for full-time employees with effect from April 1st 1964. Four decades later, the Provident fund scheme services have been extended to the part-time contingent employees (KPTCEPF) in effect from 17.03.2005. The state government has entrusted the maintenance of provident funds with the Accountant General (A&E). The office of Provident Fund Group is headed by the rank of Deputy Accountant General, IA & AS officer.

2. The Accountant General (A&E) of Kerala takes up the herculean task of catering for the GPF accounts of 3.7 lakh employees. They belong to Kerala Government employees, High court judges, All India Service officers working in Kerala. It works in accordance with the rules and procedures applied as per GPF(K) rules 1964, and AIS (PF)s rules 1955 accordingly. The funds are allotted in Indian Rupees.

Also Read: Kerala AHIMS Portal Login