KVB Net Banking Login Karur Vysya Bank Internet Banking New Registration

KVB NetBanking Login Services is one of the best Internet money transfer channels. The transfer of money is safe and secure on this channel. Yet, some customers decline Internet services because the transactions on this channel are risky. Since the Internet attracts cybercrimes, it is always advisable to be cautious when using KVB net banking services. However, do avoid the usage of KVB Net Banking in the below-mentioned situations.

- Making use of unauthentic software may lead to malware functioning on the devices.

- Smartphones or devices which run over operating systems need to be updated regularly.

- Keep changing the login password and, it is done for at least two months regularly.

- All Internet Cafés are not safe and secure and, hence it is not advisable to operate net banking on public computers.

KVB NetBanking Login New Registration Details:

Benefits of KVB Net Services:

Customers can access financial or non-financial KVB banking products online. Financial products are fund transfer, demand draft, etc. Non-financial banking products are start investments, check mortgages, manage a trading account, etc.

Features:

- KVB provides a convenient method of banking for customers. The banking system creates a password-protected feature to make customers’ accounts safe and secure.

- A customer can entertain financial and non-financial banking products/services by accessing the bank account. Bank makes it possible to access from anywhere, anytime.

- KVB provides access to customers to track and manage banking operations. In short, customers can check bank balances, last transactions, statements. In addition, mortgage payments, loans, saving bank account, etc.

Advantages:

- KVB Net banking is a 24 by 7 service:

- Customers can gain access to net banking at any time from anywhere and differ from regular banking operations.

Financial Services Online: Customers can make financial transactions with the KVB at any time. A customer can gain access to funds transfer, and bill payments, and recharge payments, etc.

Avoid Waiting in Long Queues at KVB: Banker provides access to customers to view a list of transactional history, outstanding balances through KVB Net banking services.

Safe & Secure Banking Operations: Banking operations provide financial transactions in a safe and secured manner. The KVB shall encrypt the customer login credentials for security reasons.

Non – Financial Services: Access to other services: Besides fund transfer, KVB net-banking enables the customers to make use of non-financial services such as balance check, requesting demand draft, issuance of checkbooks, applying for a personal loan, tax payment, open FD/RD deposits, start investments, check mortgages, manage a trading account, and more.

Fund Transfer: On Net-banking: Functionally, KVB does operate three types of services over the Internet. They are NEFT, RTGS, and IMPS, and banks provide these services offline as well.

National Electronic Fund Transfer NEFT is a one-to-one fund transfer, and the bank performs these NEFT operations and completes the given transactions in 30 minutes.

Real-time Gross Settlement, RTGS are monitored by the Reserve Bank of India(RBI). Once the transaction is successfully finished, it is irrevocable. This is also called Continuous settlement of funds for individuals done on an order-by-order basis. The minimum transfer of funds is INR 2 lakh.

Immediate Payment System IMPS is a real-time transfer fund that is conducted instantly within banks in India. The transfer of funds is through mobile, Internet, or ATM. The fund transfer is possible to the mobile number of the beneficiary.

Eligibility:

KVB netbanking customers should be any one of the following, residents.

- Indians

- NRIs

- HUFs

- HUFs

- Partnership firms

- Corporates.

Guidelines:

1. A customer can sign in to the Netbanking account of Karur Vysya Bank by the process of double Factor Authentication. It comprises a 4-digit PIN and, an RSA token that generates the PIN at random.

2. For joint account holders, the primary account holder is eligible to access the net banking account.

3. Every online account holder can make financial transactions with the TPIN.

4. KVB advises the online account holders to change it periodically.

KVB Internet Banking New user Registration Offline:

1st Step: An existing account holder can enroll for Internet banking and it is possible by visiting the bank.

2nd Step: Customer can be a savings account or current account. The account holder must fill the application form online. For a savings account, tick ‘Retail & Fin-Personal and Third Party, and for current account, tick ‘Corporate and Fin,’ for net banking activation.

3rd Step: Karur Vysya Bank will send login credentials through registered post in the next 5 to 7 working days.

4th Step: Offline account holders can use a username and password to get net banking account activation.

KVB Netbanking New User Registration Online:

After Opening the new account in the KVB Bank, the New users can create the Net Banking user name and password online by following the steps given below.

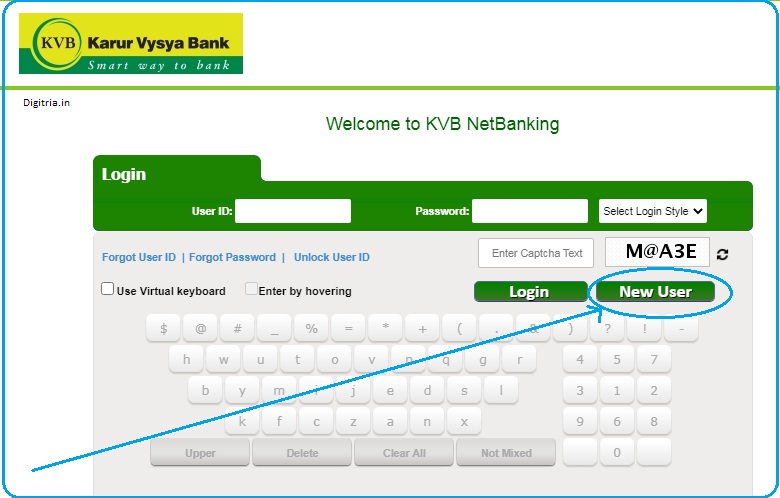

1st step: First, the Users must go through the link i.e. https://www.kvbin.com/B001/ENULogin.jsp

2nd Step: Click on the New User Option on the welcome to KVB netbankig page.

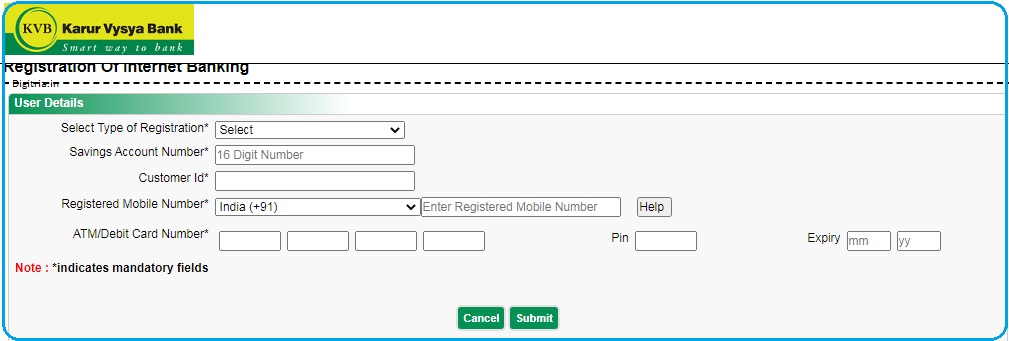

3rd Step: Read the instructions displayed on the new tap and hit on the accept Option.

4th Step: Now, users should enter the Registration Type, Savings Account Number, Customer ID, Registered Mobile number, Debit card Numer, PIN, Expiry Date and click on the submit button.

5th Step: Once you Submit the Netbanking new user registration form, Users will get the create a User name, Password page. Users must fulfill the details and create a new User ID and password.

KVB Net Banking Account: Activation:

1. KVB bank account holder must send an acknowledge mail to the net banking account at activateiuser@kvbmail.com . The account holder must send the acknowledgment from the registered email ID.

2. KVB activates the customer ID within 3-working days. The account holder will get a confirmation message on activation.

KVB Net Banking Password:

The KVB netbanking password comprises, two codes, a login password, and TPIN known as Transaction PIN. The Login password must consist of one small letter, one number, and Six Capital letters.

For Example: SVsTY5FK

TPIN is a 4-digit numeric code that is utilized when account holders perform Net transactions.

KVB NetBanking Login Process:

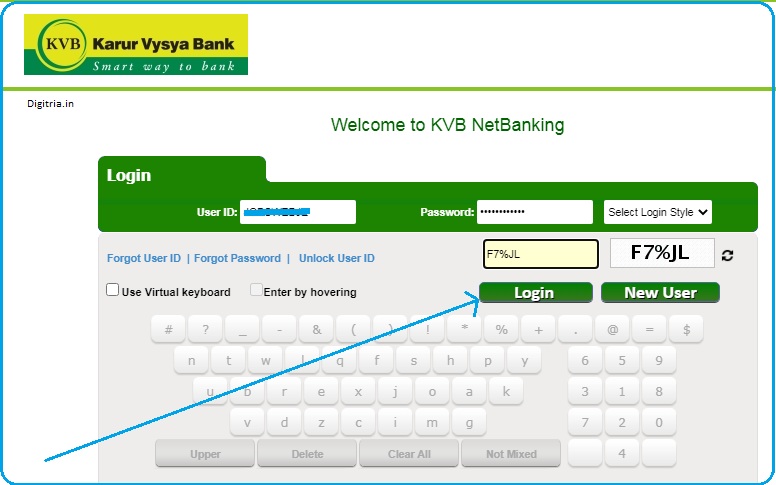

1st step: Users must open the KVB net banking portal direct link i.e. https://www.kvbin.com/B001/ENULogin.jsp

2nd Step: The account holder must enter ‘User ID’ and log-in Password and then click the log-in.

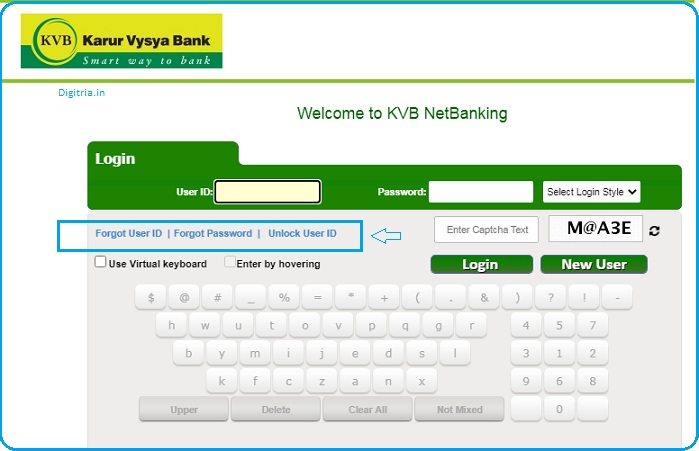

3rd Step: An account holder can unlock the User ID or seek a new User ID if forgotten from the operating portal itself. The account holder can seek help to unlock the User ID through three modes, (a) SMS, (b) Secret question on the portal, or (c) Call center.

4th Step: The account holder must send an SMS to the banker’s mobile number/message in the below-mentioned format.

- SMS KVBNET <USERID> UNLOCK to 9244770000 (or) 56161

5th Step: The account holder must administer the secret question, then select Unlock User Id from the KVB net banking login portal.

Note: The account holder must use call center support at 18602001916 and follow the instructions.

Reset Login Password:

- The account holder can reset the login password through the operating portal itself.

- Open the KVB net banking login portal then select reset log-in password. The account holder must enter the customer ID and then answer the secret question and then enter TPIN, and OTP/RSA code.

Reset TPIN:

- Select the secret question, then log in to the net banking account and select ‘Reset Transaction PIN’ from the Profile Menu. Do answer the selected secret question and set a new PIN.

For KVB Netbanking Activation:

For the account holder’s KVB online account activation, the account holder must send an SMS to the mobile number or give a missed call at the call center. Either of the processes shall activate the KVB Net banking process.

- SMS KVBNET <USERID> ACT to 9244770000 (or) 56161

- Missed Call Give a missed call to 08882737979

Also Read: ICICI Caps Login