Sukanya Samriddhi Yojana (SSY) Details, Calculator Apply Online Age Limit

Sukanya Samriddhi Yojana (SSY) Details: The Indian Prime Minister Narendra Modi Garu has launched the Sukanya Samriddhi Yojana (SSY) on 22nd January 2015 for the girl child. This scheme specially introduced for a baby girl who wants to deposit and save money for her education, marriage, and other purposes.

SSY scheme is started as part of the Beti Bachao Beti Padhao campaign. After launching this SSY scheme, the Indian people were very interested to deposit money into the child girl bank account and post office account. The main reason to become more popular in this scheme is its tax relaxation and tax benefit.

The maximum tax benefit of this SSY scheme is up to 1.5 lakh under the act of 80C. After completion of the maturity time period, there is no tax will be debited for this total amount of the SSY scheme.

So, people who are interested to invest money in the SSY scheme must check out completed details such as eligibility criteria, mode of application, mode of part payment, the process to open a child girl bank account, SSY calculation and etc from this article. We have given SSY Scheme information clearly with the proper examples on this page.

Sukanya Samriddhi Yojana (SSY) Details, Calculator Apply Online Age Limit

This scheme was launched on 22nd January 2015 by the central government for baby girl education and marriage use. If anyone is planning to invest in the SSY scheme must pay the amount from Rs. 250 to Rs.1,50,000 per year at the end of the tenure. Actually, this scheme’s starting investment was Rs.1000 to Rs.1,50,000 per year.

But the central government has modified this scheme and reduced the investment amount from Rs.1000 to Rs.250 per year from 8th July 2018. So, people can invest the amount from 250 to 1.5 lakh per annual at the end of their tenure.

As per the scheme rules, the depositors must pay the part payment of the scheme amount for 15 years. After the completion of 15 years, the depositors can withdrawal the amount from the 15th year to the 21st year.

This is a mature time period. Between the 15th year to 21st year, the depositors will not pay the part payment of the SSY scheme. However, the depositors can withdrawal the money from the child girl bank account from the 15th year to the 21st year.

How does the SSY calculator work?

The SSY calculator will show the matured amount based on the age and amount entered by you. It will show the approximate amount that you entered on the SSY calculator. The SSY scheme will mature after the completion of twenty-one years from the date of opening the bank account or postal account.

Eligibility Criteria:

1. The child girl’s age must not be crossed 10 years.

2. The girl child should have age identity proof such as a birth certificate or Aadhar card.

3. The depositors must open a bank account or postal account in the name of a child girl.

Required Document to apply SSY Scheme:

The applicants must submit the below-given documents to the respective private or Public Sector bank or Nearest Postal department and apply for this scheme.

- Birth Certificate or Aadhar Card of the Child Girl

- Photo of the Child Girl

- Parents Aadhar Card

- Address Proof of the parent

- Photo of the Parent

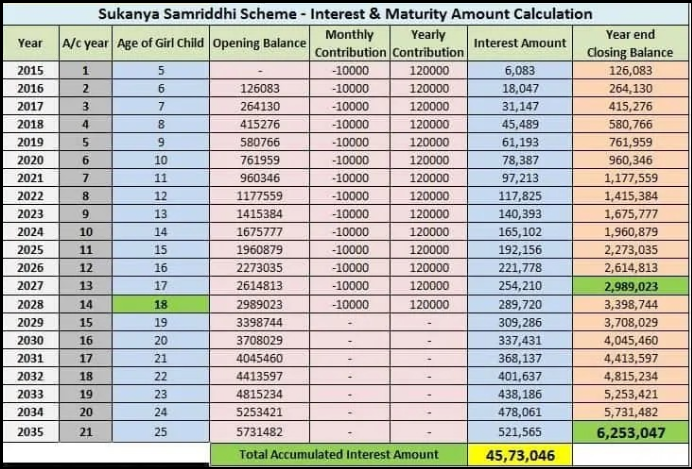

SSY scheme calculation with an example:

If your baby’s age is 1 year and pays the part payment of Rs. 24000 per year, you will get the matured amount up to 11 lakhs. The cleared image is shown below.

An Overview:

| Name of the Yojana | Sukanya Samriddhi Yojana (SSY) |

| Launched by | PM Modi Garu |

| Scheme Launched date | 2015, January 22nd |

| Eligible Beneficiaries | Girl Child |

| Mode of application | Offline |

| Online apply last date | Not mentioned By officials |

| Scheme Benefit | To get 8.6% rate of Interest for the Invest amount |

| Scheme Starting amount | Rs.250 per year |

| Maturity Time period | 15 Years |

| Check Complete details of the Scheme | Click Here |

Also Read: PM Modi Scholarship 2020-2021 Apply Online

The Process to apply for SSY Yojana Scheme Offline:

1. Visit the Nearest Private or Public Sector Bank or Post Office.

2. And, Ask the Sukanya Samriddhi Yojana Application Form from the Help desk.

3. Fill the complete SSY Scheme application form and attach the above-given documents.

4. Finally, Submit the application form with the attached documents to the Branch Manager.

Can we apply this scheme when our child is just born??

Yes. You can apply for this scheme. But the baby girl must have a birth certificate to submit the documents to the respective bank. So, before applying the scheme, you need to submit the above-given documents. Thank you.