TRACES TDS Login 2023 Registration app TDS Reconciliation Portal

TRACES Login is a web-based application developed by the Income Tax Department and it is concerned with the TDS administration. It does provide an interface between the stakeholders such as deductors, taxpayers, PAO, NRI foreign individuals, and the TDS. The web portal conducts a host of taxation services to the Citizens of India and NRIs. They can be viewed as follows:

You can view your uploaded challan status and track the processing activity. In addition, you can download the Conso file for reference, the Justification report, and Form 16/16A. The TRACS web portal allows its stakeholders to view the annual tax credit statements (Form 26AS).

Highlights of the TRACES Login Portal:

The Users can apply for the 26QB correction, make online corrections, and you can submit requests through the refund functionality. You may apply a request for resolution as a deductor, or taxpayer. You can apply online for the following issues such as Form 16/16A/16B/27D and so on.

TRACES Account Registration & Activation Process:

1. The Users will have to enter the TN TRACES web portal address in the address bar of the browser and click the search button.

2. The search results shall lead to the opening of the index page of the TRACES portal www.tdscpc.gov.in. You must select the type of registration from dropbox and click on it.

3. You must enter the TAN number and the verification code, then enter the TAN deductor, and utilize the image to verify the code. You must click the proceed button.

Completion of the KYC:

In order to complete the KYC, the Users need to enter the below details.

- Token Number/ Provisional Receipt number

- PRN

- Challan Identification Number

- CIN

- PAN amounts

Once entering the details, the users should click on proceed Option, thus completing the KYC details.

Authenticate account: You will have to authenticate your account hence enter the code and then organize your details and reach to the next.

Furnish User Details: You must enter the user account such as user id, email id, password and then confirm the password and then click on the confirm button and progress to complete your account registration.

Confirm your Registration:

1. As you enter the next page, you will see that the registration request is submitted successfully. Then you are free to move toward the activation process.

2. You will get the activation link to your email or registered mobile number along with the activation code.

Utilize the Activation Code:

1. You will have to click the activation link and enter the activation code from the SMS and the Email ID.

2. Click the confirm button to activate your TRACES Account. Once activated, you need to click on the ‘OK’ button to log in to the account.

Deductor, Taxpayer, and PAO Easy Login:

Here are the simple steps to make login and avail the benefits provided by TRACES online.

1. The Taxpayers or Deductord or PAO’s can go to the TRACES official portal www.tdscpc.gov.in and click the login button.

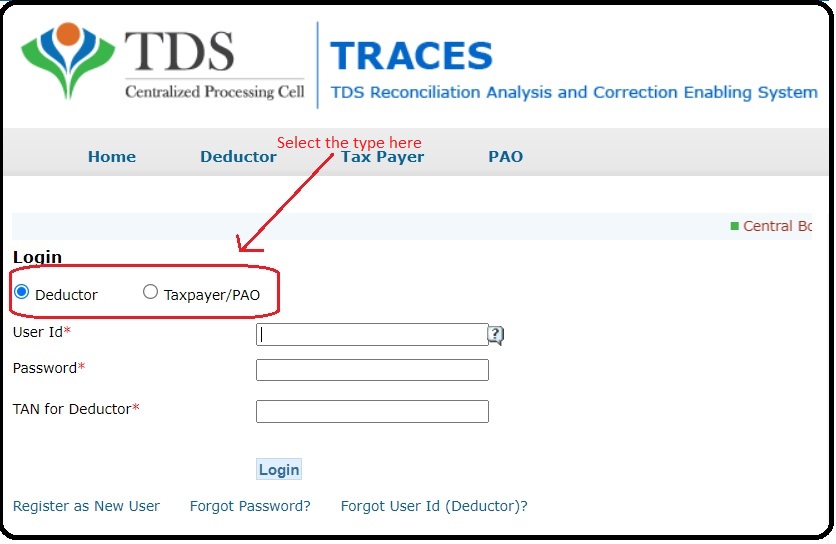

2. You must select the desired category you belong to, deductor or Taxpayer or PAO in the login page.

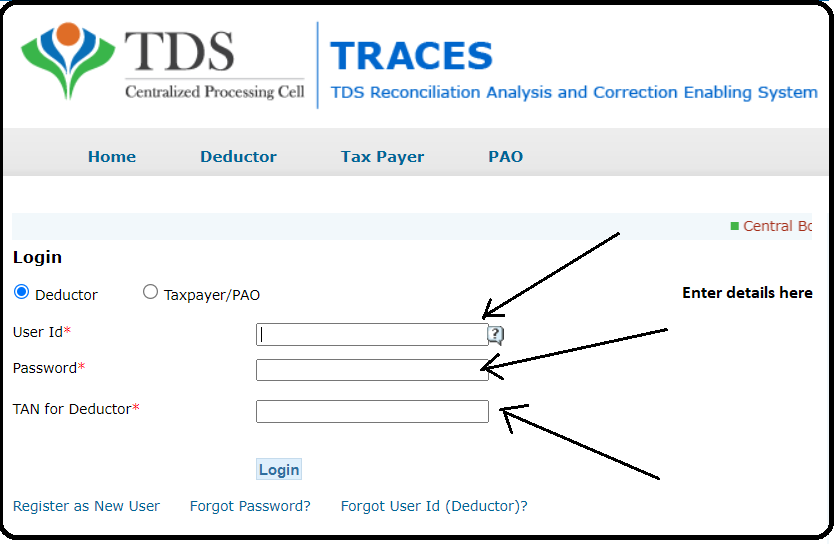

3. You must enter the userID, password, and then TAN (Deductor), PAN (Taxpayer), and AIN ( PAO). And, click the login button, it will lead you into your TRACES account.

Retrieval of User ID & Password TRACES: You may have forgotten your user ID or Password and you can retrieve your login credentials provided you do follow the instructions as mentioned by the TRACES.

Retrieve TRACES User ID:

1. You will have to get into the web portal www.tdscpc.gov.in and click the login button.

2. You need to click the forgot user ID link, and complete the KYC that is made available on the next page.

3. You will receive an OTP on the registered mobile and you need to enter the details in the OTP slot and further proceed to the next.

4. You will have to enter the PAN, and the amount for confirmation, and this will lead to the next page. On the next page, your user ID and email shall be on display.

5. You will have to enter the password, and confirm the password for the TRACES user ID retrieval.

Retrieve TRACES Password:

The procedure to retrieve a forgotten password is similar as explained above. You must fulfill the KYC page, and the OTP process, you will enter into the reset your password page. Here, you must enter the new password, and the confirm password for the password retrieval.

Helpdesk for TRACES:

1. You may have got stuck with the queries in relation to the deductors, taxpayers, or PAO and require some guidance to proceed and complete the task.

2. Aside from it, there may be a need to derive information on income tax efiling, TAN, or PAN, and so on. You can draw the best support on the stated issues by seeking contact with the helpdesk numbers.

3. They are General Queries 1800 180 1961 (or) 1961:

e-Filing- 1800 103 0025 (or) 1800 419 0025 +91-80-46122000 +91-80-61464700

TAN & PAN – +91-20-27218080 (or) +91-20-25658300.

Also Read: TIN NSDL Login 2023 Challan Status Check