TIN NSDL Login 2023 OLTAS Challan Status Pay Tax Online e-TDS/ e-TCS Status

OLTAS Challan Status: The Tax Information Network (TIN) of the Income Tax Department has two key subsystems. They are Electronic Return Acceptance & Consolidation System (ERACS) and Online Tax Accounting System (OLTAS).

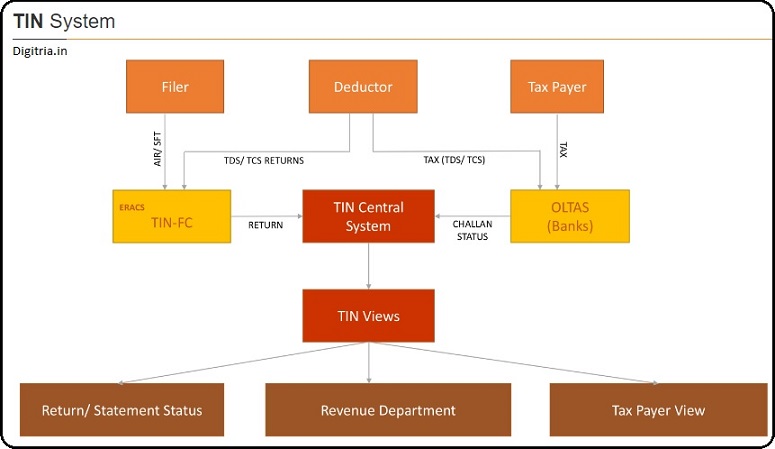

The block diagram below describes the tax information network, activities that take place in the Income Tax Department, Electronic Return Acceptance & Consolidation System (ERACS) integrates all the interfaces, a web-based utility for upload of electronic return of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS) and Annual information return (AIR)/ Statement of Financial Transaction (SFT).

In turn, these interfaces integrate with the central system of TIN. Online Tax Accounting System, OLTAS maintains the details of tax deposited in tax collecting branches. At the end of the day, the details of tax collection are uploaded to the central system of the TIN.

OLTAS Challan Status 2023 TIN NSDL e-Tax Payment PAN/ TAN:

Flow Chart of the Tax Information Network System:

Tax Information Network Facilitation Centers Renders Services:

The Tax Information Network offers services through facilitation centers across the country. To list them, they are acceptance & processing of entities. They can be defined as acceptance of electronic and physical TDS/TCS returns, AIR/SFT, and Form 24G statements. The network facilitates the processing of new PAN/TAN applications and applicants who request changes in PAN/TAN details. In addition, TIN provides the following online services on the tax information network’s official website i.e. www.tin-nsdl.com/about-us.html.

1. The online services allow taxpayers to view the quarterly statement status, e-tax payment, OLTAS challan status inquiry, PAN, TAN, e-RI, Online PAN Verification, and Form 24G.

2. A deductor can verify the status of e-TDS/TCS statements by entering the TAN and Provisional Receipt Number PRN.

3. A taxpayer can make an online tax payment provided one must have a bank account with a net banking/debit card that is in the list of the selected bank of the Income-tax department.

4. After making the tax payment, the taxpayer can make an online inquiry on the status of the challan deposited in the designated bank.

5. The taxpayers are allowed to apply for PAN online, and take a reprint of the PAN card if the details on the PAN card are revised. A taxpayer can enquire about the status of a PAN card through an online process.

6. An individual or business that deducts the tax at source as per the assigned norms of the IT department is issued a Tax Deduction Account Number or Tax Collection Account Number. TIN provides a facility to apply for TAN online, reprint of the TAN allotment letter with current or updated details. Moreover, the TAN can make a status inquiry.

7. The Income Tax Department (ITD) authorizes e-return intermediary (e-RI) to file income tax on behalf of the taxpayers through an electronic process. In addition, the e-RI can make a status inquiry as well.

8. Online Pan Verification: The Income Tax Department authorizes entities to verify PAN online and the Pan Cardholder can check for the status inquiry also.

Also Check: BBPM Property Tax pay Online

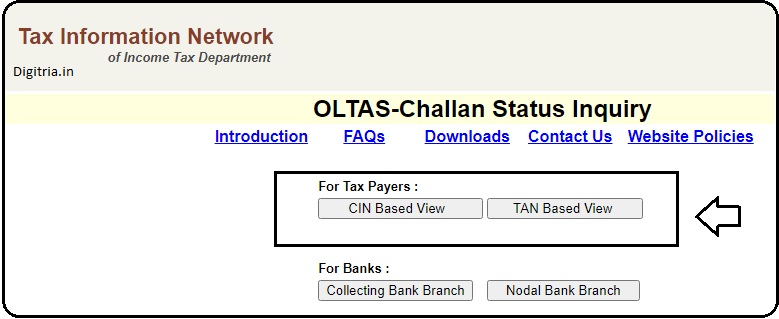

OLTAS Challan Status Inquiry:

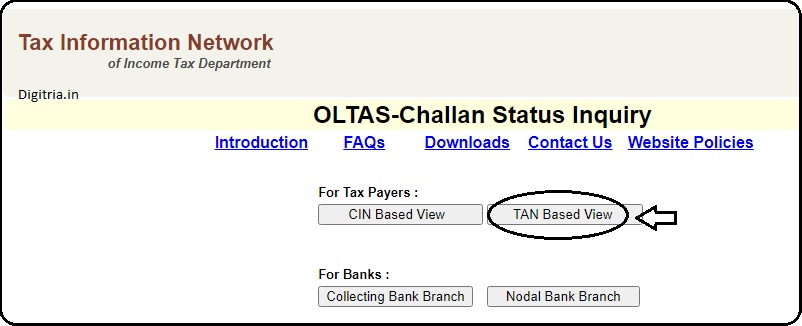

1st step: To track the challan status through the TIN portal, the taxpayers must visit the link i.e. https://tin.tin.nsdl.com/oltas/index.html.

2nd step: Using this feature, taxpayers can track online the status of their challans deposited in banks. This offers two kinds of search.

- CIN based view

- TAN based view

Challan Identification Number (CIN) View:

1. The taxpayer must insert the direct link: https://tin.tin.nsdl.com/oltas/index.html and click on the ‘CIN based View’ button.

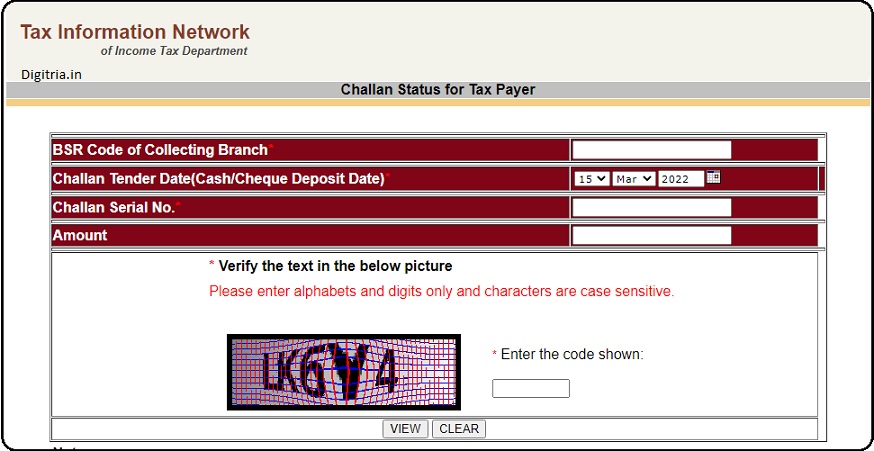

2. The web portal shall drive in the new web page, which provides a dialog box with empty blanks against the measurable parameters.

3. The taxpayer must enter the details of BSR Code of Collecting Branch, Challan Tender Date & Challan Serial No, amount (optional), and click on the ‘view’ button.

5. The taxpayer shall get to view the following details such as BSR Code, Date of Deposit, Challan Serial Number.

6. Major Head Code with description. In addition, one can view, TAN/PAN, taxpayer’s name, date of receipt by TIN, and confirmation on the entered amount.

Important Note:

1. The taxpayer must enter the details of the acknowledged challan by the banker.

2. The status of the challan can be observed after a week of depositing the tax amount.

3. If a taxpayer finds discrepancies on the query sheet then one must write a request for help to NSDL. The mode of correspondence is email.

TAN based view:

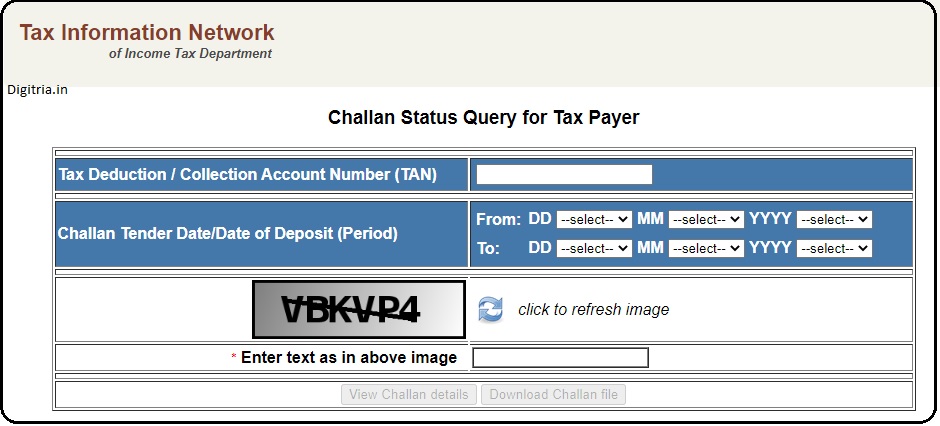

1. The taxpayer must insert the direct link: https://tin.tin.nsdl.com/oltas/index.html and click on the ‘TAN-based View’ button.

2. The web portal shall drive in the new webpage, that provides a dialog box with empty blanks against the measurable parameters.

3. The taxpayer must enter the tax Deduction/collection account number (TAN), Challan tender date/ date of deposit period, and enter the range of the financial year. The taxpayer must enter the image in the blank box and then click on the ‘view challan details.’

The taxpayer can view the following details.

They are:

- CIN

- Major Head Code with description

- Minor Head Code

- Nature of Payment.

Note: On entry of the amount against the CIN, the web portal shall validate with the amount uploaded by the bank and then issue confirmation.

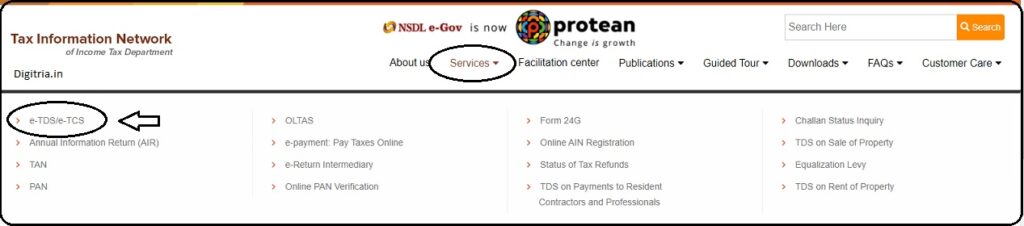

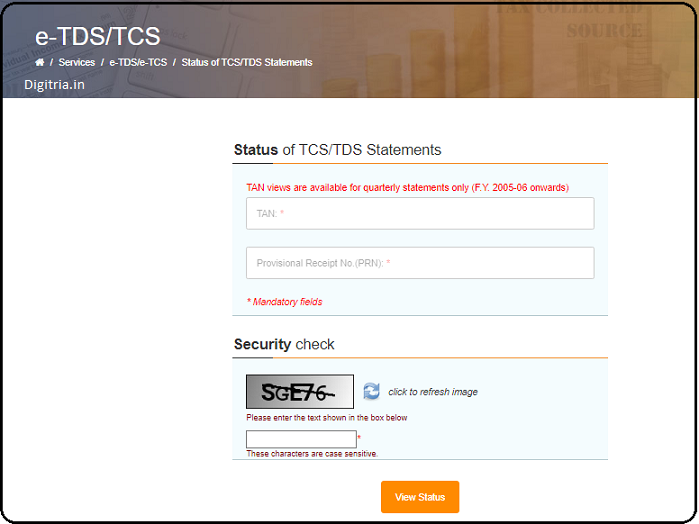

View Quarterly Statement Status:

1. To view the Quarterly Statement status, the taxpayer should go to the TIN NSDL portal.

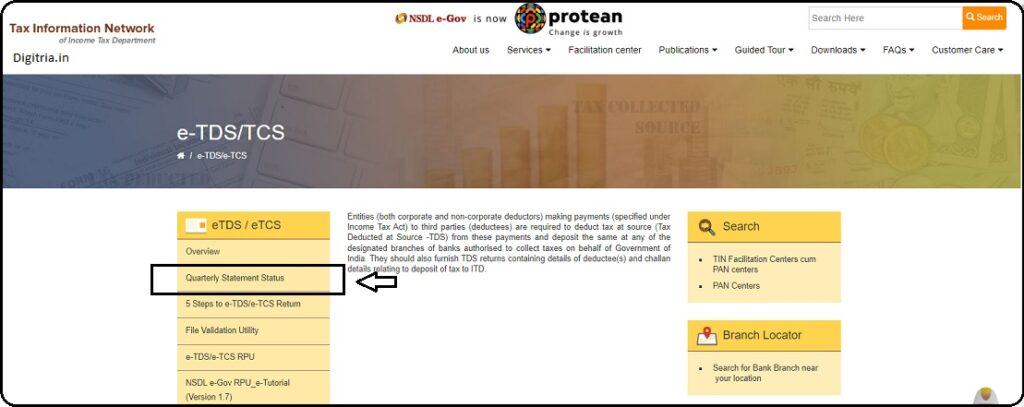

2. Tap on the Services section and click on the e-TDS/ e-TCS option.

3. The Taxpayers should check the View Quarterly Statement Status Option on the e-TDS/ e-TCS Section and click on the ‘view quarterly statement status.’ link.

2. The taxpayer must enter TAN, Provisional Receipt No, and fill the image in the box. Then, the taxpayer must click the view status.

Important Note: The web portal shall display the details of the challan status but it is reflected a week later after making the payment of the challan with the bank.

Also Check: TS Property Tax Payment Online