BBMP Property Tax Pay Online 2024 Payment Receipt, Status

BBMP Property Tax Payment: The government of Karnataka has set a totally new portal for the citizens whose properties come under the purview of the Banglore Municipality Limits. The portal is created to keep away the inhibitions on the minds of citizens in regard to property tax. The new system is called Bruhat Bangalore Mahanagara Palike (BBMP).

The citizens are urged to pay tax in time and they should also know how the government puts tax without causing a big burden. Each property is gauged under certain classified parameters and then the BBMP department sends in online payment details. What becomes more important to every tax-paying citizen is the tax calculating methods, exemptions if any, and rebates on timely or early payments.

BBMP Property Tax Payment Online Details:

The government tax department is systematic in defining six different forms that relate to different specific conditions

They are

- Form-1

- Form-2

- Form-3

- Form-4

- Form-5

- Form-6

The citizens are encouraged to make online payments and the process becomes simple if the instructions are followed in a step-by-step manner. On making a property tax payment, the citizen can have a printout of the tax receipt from the web portal. Therefore any citizen of Bangalore can seek online information on the property tax amendments as well.

Important Note:

Karnataka Government has issued the due date for the BBMP property tax for the year 2021-22 as 30 April 2021. If a property owner makes a tax payment on or before 30 April 2021 then the BBMP shall provide a rebate of 5 percent. In case, the property owner continues to make delays on payments then a penalty is added to the tax amount. For every advancing month, 2 percent shall be added.

No matter, the property owner pays for the taxation bill. But gaining knowledge on all the parameters that come to play in billing the owner’s property is highly beneficial. Hence, these are the details that go into the making of the property tax from the government’s tax department.

1. The property owner must know the value of the property and its growth in value.

2. The property is usually classified based on class and category such as residential, commercial, semi-residential, godown, and shops.

3. Another important factor is to know in which zone the property is located.

4. The property owner must have the correct dimensions of the plot or building. The owner must know the portion of the property under one’s own when there are shared properties. It could be common land or a portion of the flat under their right.

BBMP Property Tax Online Payments:

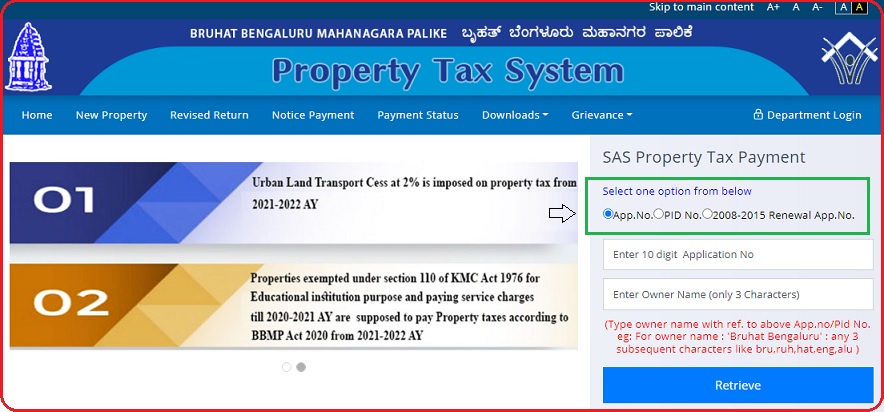

1st Step: The taxpayer must visit the official link i.e. http://bbmptax.karnataka.gov.in. The home page of the portal shall be in display.

2nd Step: The taxpayer must check for the SAS or the PID. One should prefer the ‘fetch option’ or just press on the Renewal application number.

3rd Step: Before making payment for the property tax online, the taxpayer has an option to fill in form 5 provided and one has to make changes in the existing property for the present latest update.

4th Step: In case there are any changes, the system shall reflect the new calculation on the updated property details.

5th Step: Then, the new page shall appear and the taxpayer must uncheck the check-box and provide a new mobile number in the empty space if the mobile number is to be changed.

6th Step: The taxpayer can use e-challan or debit card, net banking, or credit card to make tax payments.

7th Step: In 24 years, the taxpayer can make download of the receipt and can make use of the link: http://bbmptax.karnataka.gov.in/Forms/PrintForms.aspx?rptype=3.

BBMP Tax Offline:

1. The property holder must fill in the essential form from Form 1 to Form V whichever is applicable.

2. Property holder should generate a demand draft and then drop the form at the BBMP office dropbox.

Download Receipt Online:

1. To take the Print of the Property Tax Online, the property holder should visit the Official website.

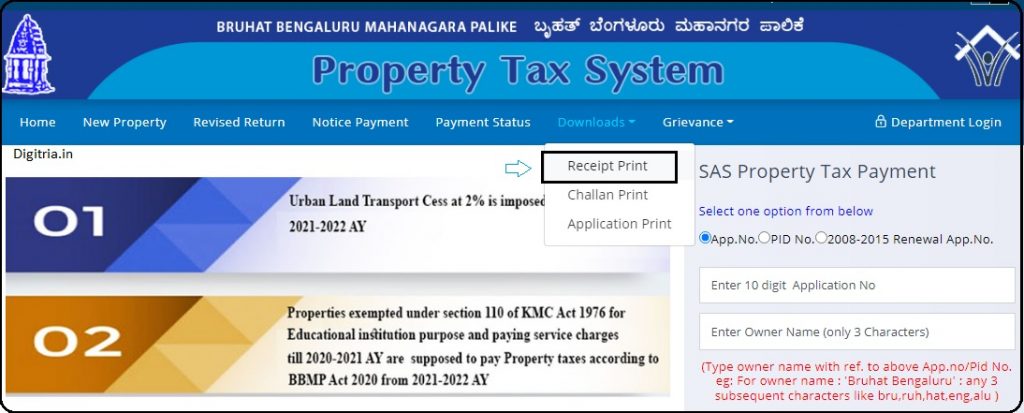

2. On the Property Tax System Home page, the Taxpayers can go through the download section and click on the Receipt Print.

3. It will appear in the address bar as https://bbmptax.karnataka.gov.in/Forms/PrintForms.aspx?rptype=3

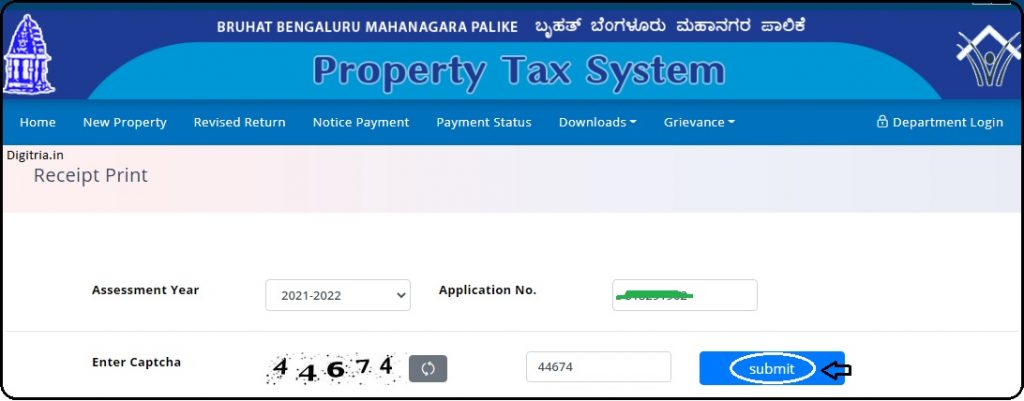

2. Once you get the receipt Print page, the taxpayers should enter the assessment number, application number and download the Receipt Online.

Calculations & Exemptions On Property Tax Payments:

When calculating on property tax, the government of Karnataka goes on in this manner.

1. The verandas and parking space are never considered while calculating the property tax.

2. Non-occupied residences shall also be liable for taxation and in addition, self-occupied properties are also taxable.

3. The vacant land property is also taxable. In any case, early payments shall attract discounts and late payments will attract additional interest as a penalty.

4. The BBMP allows cash payments for receipts over and above INR 1000.00. The property holder must use challan/ Debit card/ Credit or net banking as a mode of property tax payment otherwise.

Also Read: Telangana Property tax Bill Payment Online