Capital One 360 Login Credit Card Visa/ Platinum Bank Shopping Login

Capital One Login: With headquarters in McLean, Virginia, Capital One offers a wide range of financial products and services. The bank serves retail customers, small businesses, and commercial clients. To them, the bank renders services through several channels. The company is a financial holding company with two subsidiaries, Capital One, N.A., and Capital One Bank (USA), N.A. As of 30th June 2020, the company has an asset value of $304.2 billion in deposits and $421.3 billion in total assets.

Capital One, N.A. operates at different locations such as New York, Louisiana, Texas, Maryland, Virginia, New Jersey, and the district of Columbia. It is listed in the Fortune 500 companies, and the company is set in the New York Stock Exchange and also holds its position in the S & P 100 index.

Capital One Impact Initiative:

1. The bank extended a five-year commitment to enable the growth of the underserved communities and attain advancement in socioeconomic mobility. The funds allotted is an initial of $200 million under the Capital One Impact Initiative.

2. The Impact Initiative is designed and is lined up to the core values of Capital One. The basic function of the impact initiative is to match the set priorities.

3. The key factors are the prioritization around racial equity, affordable housing, and providing small business support. In addition, development of a proper workforce, and financial well-being.

4. Racial Equity: The bank works in the interests of Black and Latinx communities. It makes investment in these communities and empowers their businesses. Also, extend support to organizations that work directly to empower these communities.

5. Affordable Housing: The bank in the impact initiative program, binds with nonprofit organizations, for-profit real estate developers, and the government. It facilitates affordable housing to the black and Latinx communities with diverse households.

6. Small Business Support: The programs are designed to support the black and Latinx communities in small businesses. The bank provides investments to Latinx and black partners and enhances their capabilities. These business communities are mentored, trained, and advised to undertake good initiatives towards success.

7. Workforce Development: Black and Latinx businesses may need an impetus to derive better results in the rapidly changing employment markets. In such situations, the bank helps with programs that involve workforce development.

8. Financial Well-being: The bank enables in creating simple, digital products that help the customers in serving their basic purposes.

Financial Commitment to Advance Socioeconomics:

Capital One has recently made a commitment of $10 million to extend the cause of social justice for black communities. An additional fund of $50 million is committed to address the economic needs of the dislocated families, a result of the Covid-19 pandemic.

CapitalOne Services:

Capital One company holds expertise in credit card businesses, auto loans, savings, and banking. It has an exclusive Capital One Spark Business credit card that offers massive benefits to its customers.

1. The credit card returns 2 percent on the purchase of products and services are done.

2. If a user spends 4500 dollars within three months after issuing the Spark Business card then the user shall get a 500 dollars rewards cash.

3. A credit cardholder need not make an annual fee up to 12 months.

Salient Features of CapitalOne Overdraft Policy:

1. The customers of Capital One will not be charged with overdraft fees and the Credit card company shall provide overdraft coverage.

2. If a customer enrolls for the next day’s grace then the company shall be provided with a No-fee overdraft option. However, the company gives an option to the customer to enroll for an overdraft option at any time.

3. Customers who do subscribe with the services of no-fees Overdraft coverage, can find benefits covered in the following areas.

4. The company shall provide no-fee overdraft coverage for check payments, electronic bill payments. In addition, recurring debit card payments, one-time debit card purchases.

5. In case the company doesn’t approve payments in any of the above-mentioned ones, then even overdraft fees shall not be charged.

6. If the company stays committed to make payment for an overdraft item then the beneficiary must deposit the additional funds.

7. In case a negative balance exists in the checking account then CapitalOne is authorized to close down the account and on reporting, financial banking institutions may also not let in.

Eligibility for No-fee Overdraft Coverage:

A new rule is to set on No-fee overdraft coverage from April 2022 onwards. A customer must deposit at least $250 in 2 out of every 3 previous calendar months. Until and unless this condition is met, a customer shall never be entitled for an overdraft.

Capital One Services:

Capital One company holds expertise in credit card businesses, auto loans, savings, and banking. It has an exclusive Capital One Spark Business credit card that offers massive benefits to its customers.

The credit card returns 2 percent on the purchase of products and services are done.

If a user spends 4500 dollars within three months after issuing the Spark Business card then the user shall get a 500 dollar rewards cash.

A credit cardholder need not make an annual fee up to 12 months.

Also Read: Key2benefits Login

Register Capital One at Capitalone.com:

1st step: To register on the Capital one portal, Users must go to the official web portal www.capitalone.com and tap on the sign-in button.

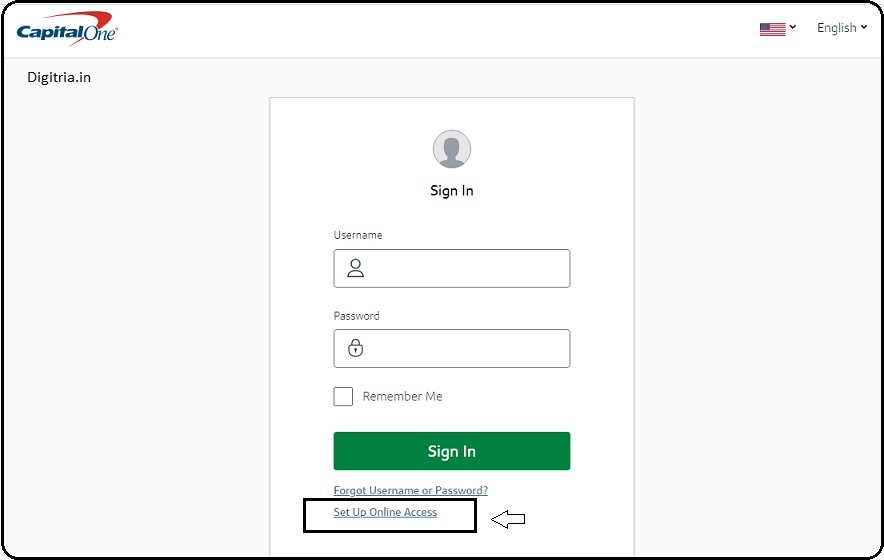

2nd Step: On the sign-in page, users should click the link to set up online access.

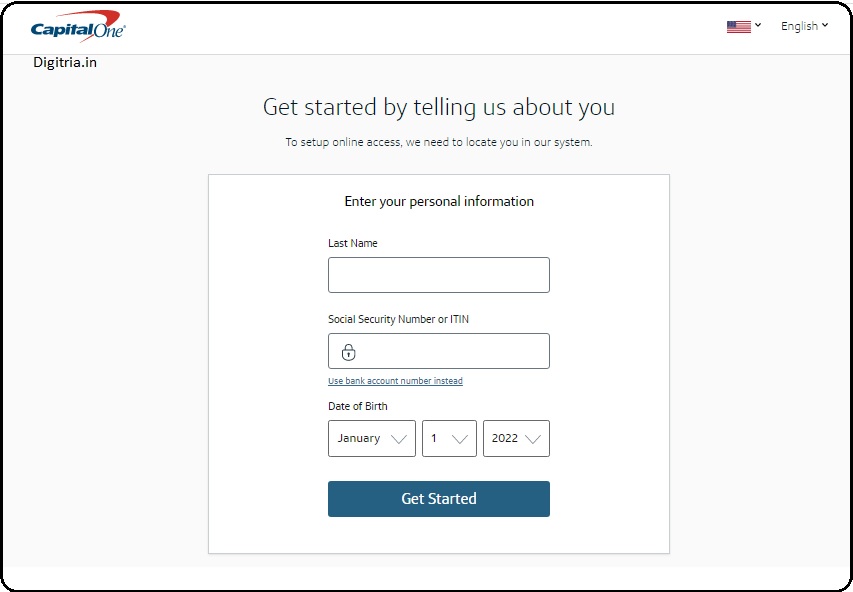

3rd Step: The Users must enter the verification details such as last name, social security number, date of birth, click on the ‘Get Started button.’

Capital One Login:

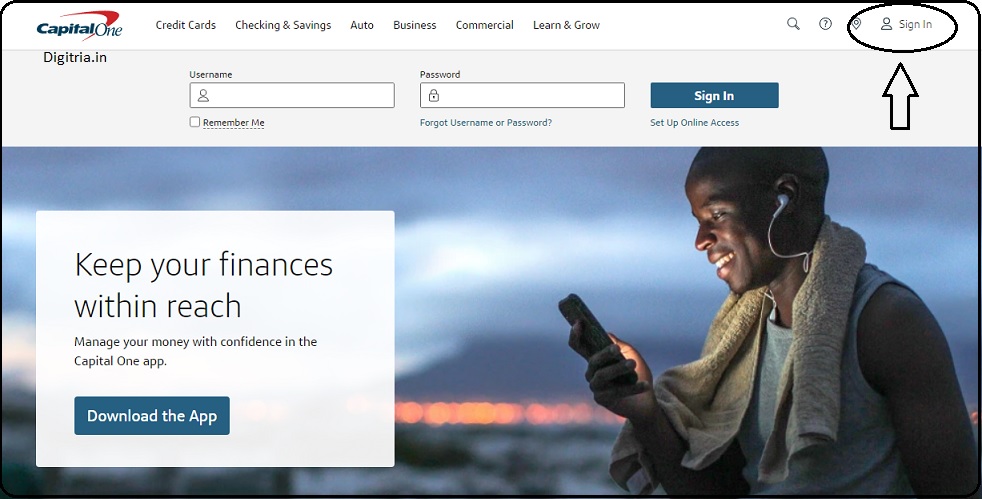

1st step: The Users must visit the Capital one official website address: www.capitalone.com.

2nd Step: On the official website home page, users can click on the sign-in option.

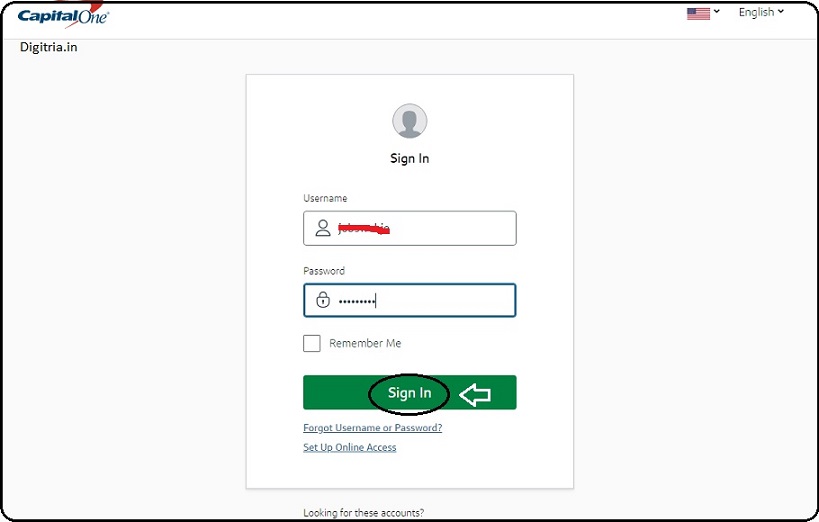

3rd step: After getting the sign-in page, Users should enter the username, password and click on the sign-in button.

Recover password:

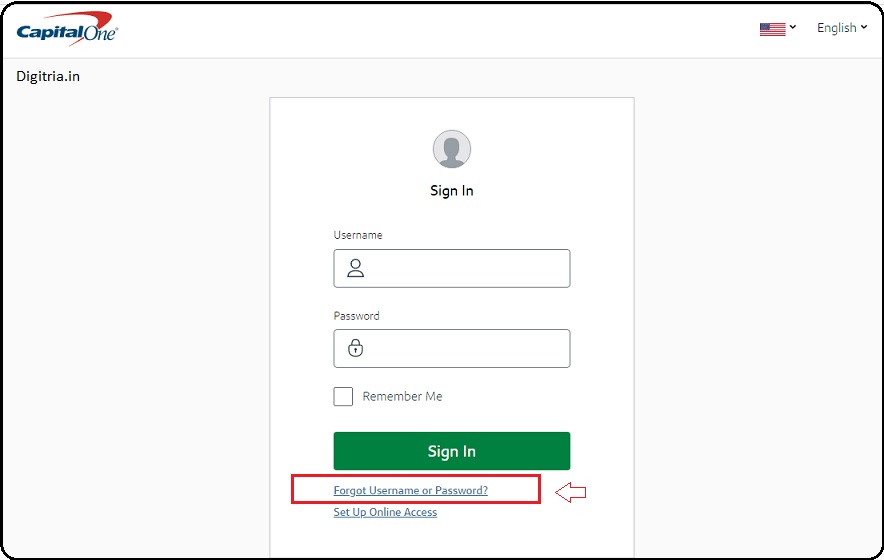

1. Go to the official portal sign in page like https://verified.capitalone.com/auth/signin.

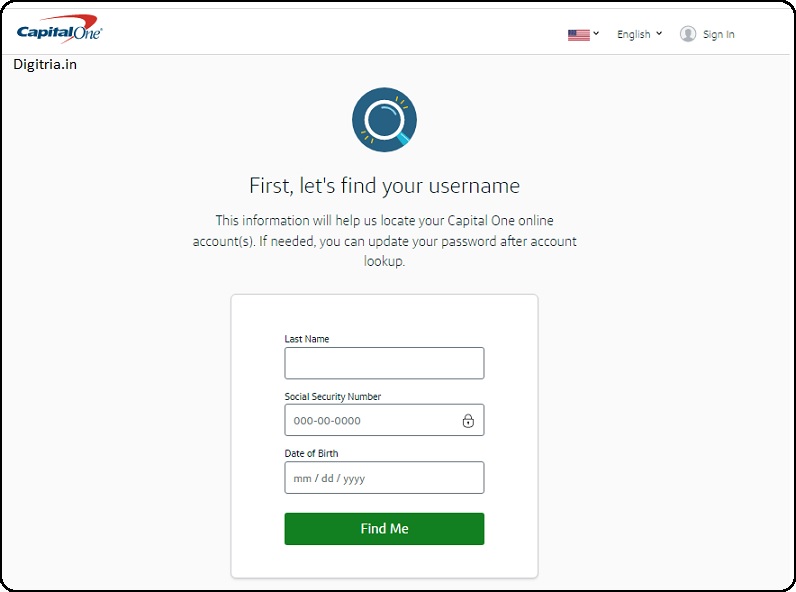

2. click on the link ‘forgot username or password?’ and it will open the verification page.

3. The user will have to enter some basic information such as last name, social security number, date of birth and click on the ‘Find Me’ button. It is just to verify whether it is the right user or not. Then, the website enables the user to recover the password.

Also Check: FAFSA Student aid Login