IFMS Uttarakhand Treasury Payslip 2024 employee Salary Slip ifms UK app

IFMS UK Treasury Payslip: Integrated Financial Management System devised and developed by National Information Center, NIC, Poona, Maharashtra. This financial management system caters to the needs of the Uttarakhand financial management system (UKFMS). The government of Uttarakhand directs the finance department to issue online payslips to the employees.

The Financial Department of the Uttarakhand state govt has launched an official website for UK employees. It allows employees to seek salary payslips from the official website https://ekosh.uk.gov.in. The article speaks in detail about the significance of employee payslips, the benefits the web portal provides to employees, login procedures, and password retrieval.

IFMS UK Treasury Payslip Login 2023 Salary Slip Details:

Employee Payslip:

The salary payslip of an employee contains several fields that describe the income and the liabilities owned. The payslip defines the monthly income of an individual and deductions if any. The Sum total of income earned per month and deductions per month speak about the total net salary. It is deposited in the bank through the approval of the treasury department.

The basic details that can be found on the salary payslip 2023 is the employee’s personal details, basic details such as Employee Code, Employee Name, GPF number/PRAN number, designation, GLI number, PAN number, Bank Details, and the pay scale are made available in the payslip.

The other part of the salary slip 2023 shall contain the details of earnings: They include basic pay, DA, HRA, Allowance, and other deductions details. They can be GPF, GIS Installment, Professional Tax, Recoveries, GLI, NET amount, the gross amount of the salaries are mentioned.

Significance of Employee Payslip 2023:

The payslip plays a huge role in seeking loans from financial agencies. An employee can produce a three-month salary slip 2023 to any financial institution and seek an instant loan. The loan can be of any kind such as a home loan, vehicle loan, or mortgage. A financial institution considers a payslip as a valid document since it is issued by the Uttarakhand Treasury Government Dept.

A simple download from the official website can enable an employee to get a loan in a hassle-free manner.

Benefits of Uttarakhand Payslip:

1. The basic purpose of the IFMS Ekosh Portal is to view Uttarakhand’s employees’ salary slips online. Every employee can view and download it through a digital medium.

2. The website allows the employees to display monthly, and annual income such as leave, loans, and allowance. The entire database is centrally placed on one server.

3. The employee need not visit various departments to get their queries sorted. The need to make frequent visits to the finance department or treasury department at the rural/district/ State level shall not be essential.

4. The employee can access the salary slip information for a time greater than viewing it at the concerned department.

5. The employees’ information on the web portal shall allow them to access it at any time from anywhere.

6. The employee can also view important circulars, and notices and register queries, complaints, and grievances online.

7. The employees can make the bill payments over ekos.uk.gov.in/

8. The employee’s details can be accessed through, the State Financial Department and State Treasury Department.

Contact Us Page Solves Employees Queries: The Uttarakhand web portal shall provide any information in regard to employee queries and by clicking on this link https://ekosh.uk.gov.in/contactus, one can find a list of treasury offices at various districts along with the official names and their corresponding phone numbers with mailing addresses. The employee can contact the concerned department and the treasury officer to get their queries clarified.

IFMS UK Treasury Payslip Login:

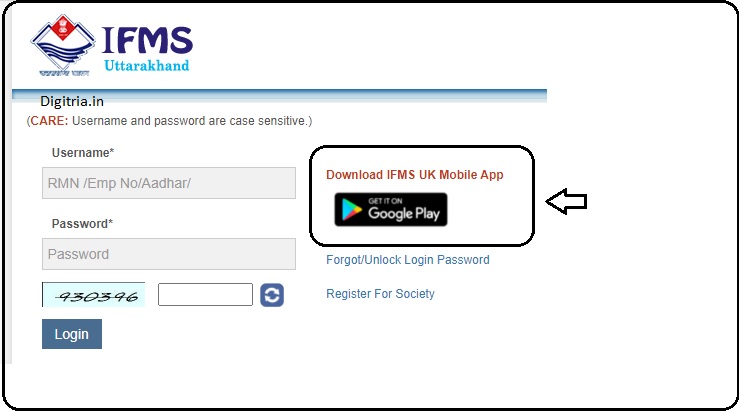

Every government employee of Uttarakhand is advised to log in to the treasury login portal designed by IFMS. An employee can make an easy entry by following it in a step-by-step manner.

1st step: Employees of Uttarakhand should visit the ekosh portal i.e. https://ekosh.uk.gov.in.

2nd Step: The employee must log in to IFMS Tap on the homepage.

3rd Step: The web portal shall redirect to the new page, and the employee is expected to fill in the login details.

4th Step: The employees will have to enter RMN/ Employee Code/ ID or the Aadhaar Number, password, and security code image and click on the login tab only after rechecking the inputted details.

7th Step: The web portal shall generate EKOSH UK salary slips per month and year as per the concern shown by the employee.

Forgot Password its Recovery:

The employee can make easy recovery of the forgotten password. It can be obtained at https://ekosh.uk.gov.in/ (or) https://cts.uk.gov.in.

1. The employee must insert any one of the website addresses in the web browser and click on the search button.

2. The employee must make a selection of the login on the homepage at the CTS tab.

3. The employee must select the forgot password tab made available on the login page.

4. The web portal shall drive the web page to a new webpage on the screen. The employee must enter the employee code.

5. The employee must enter the registered mobile number with the web portal.

6. The employee must select the option and receive the OTP at the registered mobile.

7. The employee must type in the OTP obtained at the registered mobile phone to validate the employee credentials.

8. Further, the employee should reset the password as per the govt Instructions.

Also Check: IFMS MP treasury payslip Login

IFMS UK Treasury app Download process:

1. To download the IFMS UK app, employees should visit the IFMS UK Portal i.e. https://ifms.uk.gov.in/.

2. Tap on the Google Play Store Button on the IFMS Login web page as shown below.

3. Once you get the IFMS UK (Early Access) page, employees can hit on the Install button and download the mobile app.